Loonie Testing Key Support Ahead of CAD Inflation

USD Sinks on Fed Easing Expectations

Dollar weakness is the main theme of markets this week. With US inflation seen falling last week for a fourth consecutive month, Fed easing expectations have moved firmly higher with traders now pricing in at least .75% worth of cuts this year. The July FOMC minutes this week and, more importantly, a speech from Fed’s Powell, hold the power to drive USD down further. This will be the first time hearing from Powell since the July FOMC and on the back of last week’s sub 3% CPI print, traders are widely expecting a more dovish tone from the Fed chair.

Risk-On Boosting CAD

The change in Fed easing expectations has fuelled a major shift across FX markets, with commodity currencies rallying amidst a pick up in broader risk appetite. CAD has been a big beneficiary of the current USD rout, despite the BOC being firmly planted in its own easing cycle. With JPY under pressure amidst a rebuilding of the carry trade and USD vulnerable to further downside, CAD has room to continue higher near-term.

CAD Inflation Due Next

Looking ahead today, focus will be on the latest set of Canadian inflation data. Readings are expected to have moved slightly lower across the board last month which, if confirmed, will keep BOC easing expectations intact. However, only a sharp downside surprise is likely to impact CAD strength. Meanwhile, if we see any upside surprise, this could further exacerbate current USDCAD selling.

Technical Views

USDCAD

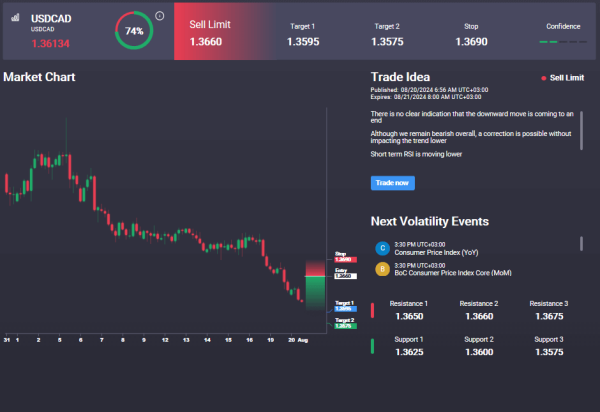

The failed break above 1.3866 has seen the market reversing sharply lower. Price has broken back under the bearish trend line and is now testing support at the 1.3587 level. This is a major support zone for the pair and a break here will be firmly bearish, turning focus to .13377 next, in line with bearish momentum studies readings. In the Signal Centre today we have a sell limit at 1.3660 suggesting a preference to fade any recovery bounces and stay short.