Lumen Technologies gains 81% after securing $5B in new contracts 💰

Lumen Technologies (LUMN.US) stock is gaining almost 80% to 5.1B market cap after the company announced after yesterday's market close that it secured $5 billion in new business driven by major demand for connectivity fueled by AI. Major companies across various sectors are urgently seeking fiber capacity to support their AI-driven operations. Lumen is actively pursuing an additional $7 billion in potential sales to further capitalize on this booming demand. As part of this expansion, Lumen plans to more than double its intercity network miles and has entered into a significant agreement with Corning Incorporated (GLW.US) to supply next-generation fiber-optic cable essential for AI applications. This partnership will notably enhance Lumen's capacity to meet the escalating infrastructure needs of data centers and other high-bandwidth applications.

Preview of Upcoming Q2 Earnings

Lumen is scheduled to release its Q2 earnings Today after market close. Expectations are set for a consensus EPS estimate of -$0.04, a 140% decline year-over-year, and a consensus revenue estimate of $3.25 billion, reflecting an 11.2% decrease from the previous year. Despite the company's significant advancements in securing new contracts and expanding its network for AI applications, financial analysts remain cautious. The recent adjustments in EPS and revenue estimates have trended downward.

Company Business and AI segment

Lumen Technologies is a global technology company fundamentally focused on providing network solutions that support the data and connectivity needs of various industries.

Lumen's recent strategic moves, including the creation of a Custom Networks division and partnerships for next-generation fiber-optic cable supplies, underscore its commitment to being at the forefront of the AI revolution. This division specifically caters to large organizations, providing customized network solutions that support AI-intensive workloads through dark fiber, custom fiber routes, and digital services.

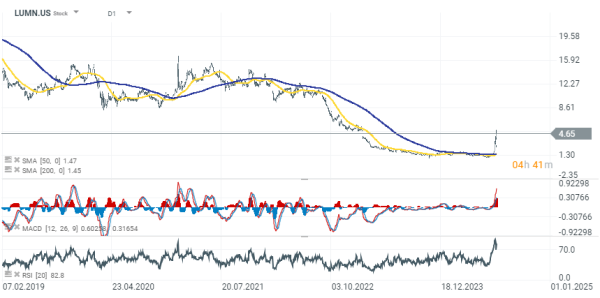

Lumen (D1 interval)

Despite record gains during today's session, Lumen's stock price still remains at significantly lower levels than just 2–3 years ago. The multi-year downward trend reflects the condition of the company, which was much less attractive to investors before the AI revolution.

Source: xStation 5

Source: xStation 5