Macro Trader: The Curve Is Back To Normal

Goodbye to the inverted yield curve.

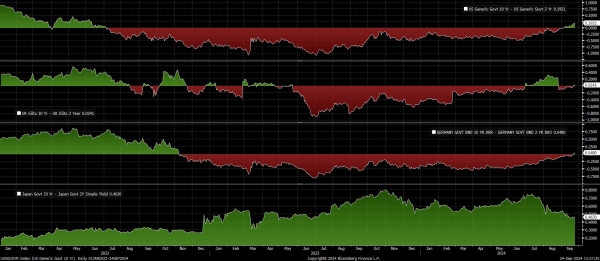

It was fun while it lasted, but DM government bond markets have seen a return to normality over recent weeks, with the 2s10s curves in the US, UK, and finally Germany having dis-inverted after a prolonged inversion over the last couple of years.

Preview

PreviewOf course, curve inversion is an unusual phenomenon where, as opposed to the traditional upward sloping curve where a greater yield is on offer for longer maturity debt, the opposite is true, with longer-term debt yielding less than comparable short-term notes.

It is central banks that we have to thank for restoring a degree of normality in the fixed income market, as policy normalisation gets underway in earnest, and rate cuts are delivered across G10. Said rate cuts, as the market discounts further easing in the short-term, have dragged short-term yields lower, with the front-end – as always – especially sensitive to policy developments.

At the same time, longer-maturity debt has actually sold-off of late, most notably in the US, causing the curve in its entirety to steepen. Stateside, this bear steepening has taken the 2s10s to just shy of 20bp, its widest since mid-2022.

Preview

PreviewNaturally, the bond market remains one of the most important signals of market-based expectations – whether those expectations be for policy rates, inflation, or economic growth.

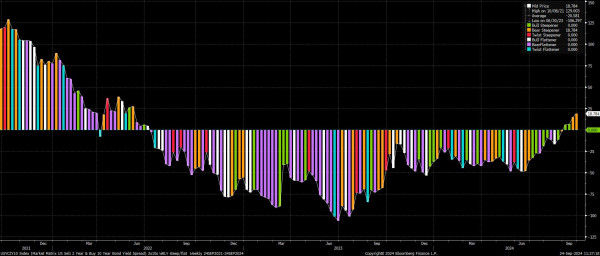

The steepening in the Treasury curve appears to be sending a relatively clear message, in that participants are displaying an increasing degree of concern that the FOMC’s 50bp cut last week was too much, too soon, in terms of the removal of monetary policy restriction. Naturally, this is fanning the flames of concern that the magnitude of policy easing is too significant, into an economy that continues to grow at a solid clip, potentially raising the risk of inflation rearing its ugly head once more.

Consequently, it seems like the present steepening, which should continue across DM, is likely to remain more significant in the Treasury curve. While the US economy has grown at an annualised rate north of 2% in seven of the last eight quarters, and is set to notch Q3 GDP growth of 2.9% per the Atlanta Fed’s tracker, growth elsewhere remains significantly more anaemic.

Strengthening the case for a more rapid steepening across the pond is the FOMC’s clear desire to act aggressively in delivering rate cuts, adopting a much faster path back to neutral than G10 peers. While, for instance, the BoE seem set to deliver quarterly 25bp cuts, the FOMC are likely to deliver such a cut at every meeting, with the prospect of a larger 50bp move remaining on the table if the labour market were to further weaken – i.e., unemployment rising north of the 4.4% median SEP forecast.

Such a rapid return to neutral is likely to pose a headwind to the USD, with rally selling the preferred strategy in the short-term, parring any overt nods from other G10 central banks towards larger cuts in the months ahead – the BoC, and the ECB, have the highest potential here for a dovish turn.

Preview

PreviewStocks, meanwhile, should remain underpinned for the foreseeable, with the path of least resistance continuing to lead to the upside, amid the forceful central bank put, whereby investors will retain confidence to remain further out the risk curve, safe in the knowledge that policymakers have as much as 200-250bp further room to ease were it necessary, in addition to being able to slow, or end, the process of balance sheet reduction were additional liquidity provision to be required.