Market Analysis: Anticipation Builds Ahead of Central Bank Communications

Financial markets are poised for a week of significant central bank communications and key economic data releases. The US Dollar is under pressure, leading to a modest rise in the EUR/USD pair. Investors are closely watching Federal Reserve Chair Jerome Powell's upcoming speech for clues on the Fed's monetary policy trajectory. Simultaneously, decelerating inflation in the Eurozone is influencing expectations around the European Central Bank's next moves. The British Pound is exhibiting strength amid speculation that the Bank of England may adopt a less aggressive rate-cutting path compared to its G-7 counterparts.

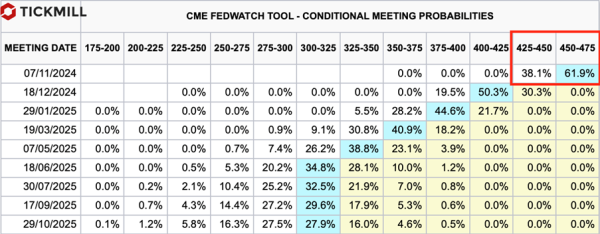

The USD has softened as market participants anticipate Fed Chair Powell's speech later today. The key focus is on the potential size of interest rate cuts in the November FOMC meeting. According to interest rate futures, there's a 38.1% probability of a 50 basis point rate cut to a range of 4.25%–4.50%. This probability has decreased from 53% following the release of the August PCE data:

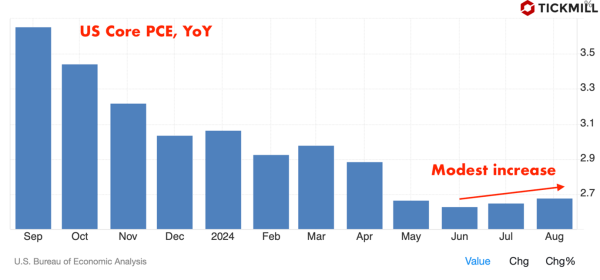

The headline PCE inflation decelerated to 2.2% annually, the lowest since February 2021, suggesting easing price pressures. However, core PCE inflation edged up to 2.7% from 2.6%, indicating persistent underlying inflation. This divergence complicates the Fed's decision-making and bond market pricing shows that it somewhat tamed bets on an aggressive rate cut at the upcoming meeting:

The Fed is balancing its mandate of price stability with maximum employment. Recent commentary suggests a shift toward preventing job losses and mitigating economic slowdown risks. Upcoming labor market data—including JOLTS Job Openings, ADP Employment Change, and NFP—will be critical in shaping expectations.

The mixed inflation signals highlight the challenge for the Fed. While headline inflation is easing, sticky core inflation may compel the Fed to adopt a cautious approach. Market expectations might adjust further based on Powell's remarks and labor market data, influencing USD volatility.

The Euro has gained modestly against the USD amid signs of slowing inflation in key Eurozone economies. The Harmonized Index of Consumer Prices (HICP) in Germany grew by 1.8% annually in September, below the 1.9% forecast. Similar trends are observed in France and Spain, where inflation grew at a slower-than-expected pace in September.

Investors have increased bets on an ECB rate cut at the upcoming October 17 meeting, with a 75% probability priced in, up from 25% the previous week. This added pressure on the Euro, resulting in increased intraday volatility in the USD and a slowdown of the uptrend:

The deceleration in inflation across major Eurozone economies strengthens the case for the ECB to ease monetary policy. However, the ECB must weigh this against other factors like economic growth and external risks. A rate cut could further impact the Euro's performance against major currencies.

The GBP is showing resilience, outperforming major peers at the week's start.

Revised Q2 GDP figures show the UK economy grew by 0.5% quarterly and 0.7% annually, both slightly below initial estimates. While the economy is expanding, the slowdown may factor into the BoE's policy decisions.

Investors anticipate that the BoE will adopt a less aggressive rate-cutting cycle compared to other G-7 central banks. Market participants expect only one more 25 bps rate cut in the remaining two meetings this year.Attention is on BoE MPC member Megan Greene's speech later today. Greene has previously voted to keep rates unchanged, and her insights could influence market expectations.