Market Analysis: Euro Under Pressure Amid Persistent US Inflation and Diverging Central Bank Policies

Today’s market action reflects ongoing divergence between the US Federal Reserve and the ECB, driven by differing inflation dynamics and monetary policy trajectories. The EUR/USD pair slid back towards the key support level of 1.0935 during Friday's New York session as the US Dollar gained momentum following the release of hotter-than-expected US PPI data:

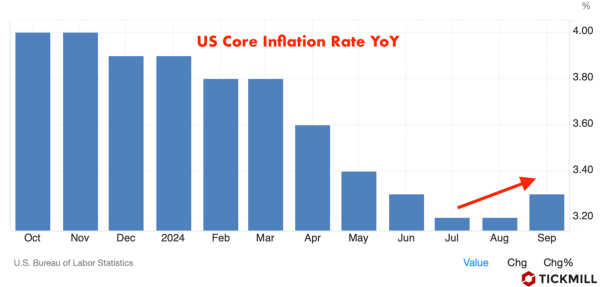

The latest PPI figures revealed that producer inflation remains more persistent than markets had anticipated. The annual headline PPI decelerated marginally to 1.8% (from 1.9% in August), but this was above expectations of 1.6%. Meanwhile, core PPI, which excludes food and energy prices, rose by 2.8%, surpassing estimates of 2.7%. This comes on the back of Thursday's CPI release, where annual core inflation accelerated to 3.3%. These figures signal that the battle against inflation in the US is far from over:

While traders continue to expect a 25 bps rate cut in the near future, largely driven by concerns over the labor market, the persistent inflationary pressure complicates the Federal Reserve’s decision-making. Fed officials, including Atlanta Fed President Raphael Bostic, are now suggesting the possibility of a pause in rate cuts for November. Bostic’s cautious stance, citing inflation's choppiness, aligns with the data showing inflation is not decelerating as quickly as expected.

This inflationary resilience provides upside support to the USD, as reflected in the US Dollar Index (DXY) striving to climb above the 103.00 level. It reflects both short-term strength in the US economy and higher-for-longer interest rate expectations, reinforcing the relative appeal of the dollar versus its peers, particularly the euro.

On the contrary, the ECB faces a more dovish trajectory as inflationary pressures in the Eurozone continue to cool. The revised German Harmonized Index of Consumer Prices (HICP) for September came in at 1.8%, below the ECB’s 2% target. Meanwhile, comments from ECB policymaker Yannis Stournaras indicated that price pressures are declining faster than the ECB had projected in September. As a result, expectations for further monetary easing have accelerated, with markets pricing in two additional 25 bps rate cuts—one next week and another in December.

Eurozone inflation has been on a downward trend, and with risks to economic growth mounting, the ECB has little choice but to remain accommodative. This dovish stance has continued to weigh on the euro, as traders price in prolonged economic weakness and easier monetary policy relative to the US.

The USD's continued resilience, underpinned by sticky inflation and the potential for a pause in rate cuts, makes it an attractive safe haven in the near term. Conversely, the euro faces downside risks as further rate cuts are almost baked into market expectations. The EUR/USD pair, which remains near key support levels, could see further depreciation if the ECB’s dovish stance persists.