Market Analysis: EUR/USD Stabilizes Amid Inflation Data and Geopolitical Uncertainty

The EUR/USD pair struggles to rebound on Wednesday, hovering near the 1.1050 level after a heavy intraday loss on Tuesday. This stabilization comes amid a mix of economic indicators and escalating geopolitical tensions that are influencing investor sentiment:

Euro’s short-term bullish outlook has been eroded by the release of lower-than-expected inflation data from the Eurozone. The Harmonized Index of Consumer Prices (HICP) grew by 1.8% year-over-year in September, down from 2.2% in August and below market expectations of 1.9%. Core inflation also dipped to 2.7% from 2.8%, missing forecasts.

This decline is significant as it brings headline inflation below the ECB’s 2.0% target, suggesting that price pressures are easing more rapidly than anticipated. The softer inflation data increases the likelihood that the ECB may consider cutting interest rates or implementing additional monetary easing measures to stimulate economic activity.

From an investment standpoint, the prospect of further rate cuts by the ECB could diminish the interest rate differential with the Fed, potentially leading to capital outflows from the Eurozone. This shift may weaken the Euro against the US Dollar as investors seek higher yields and safer assets.

The Eurozone unemployment rate remained unchanged at 6.4% in August, aligning with economists' expectations and July's figures. However, this data had little impact on currency movements.

In the Eurozone, stricter employment laws and robust social welfare systems contribute to a more rigid labor market. Layoffs are less common, and job turnover is lower compared to the United States. This stickiness means that employment figures are less sensitive to short-term economic fluctuations, making them less influential on monetary policy decisions. Consequently, inflation reports take precedence in guiding market expectations, as they provide clearer signals about underlying economic conditions and potential policy responses from the ECB.

The US Dollar gained strength following the release of the JOLTS report, which showed that job openings rose to 8.04 million in August from a revised 7.71 million in July. This figure surpassed expectations of 7.66 million, suggesting resilience in the US labor market. While the uptick is a positive sign, one month of data is insufficient to fully dispel concerns about a potential economic slowdown. The Fed has recently shifted its focus toward labor market dynamics as it balances its dual mandate of maximum employment and price stability.

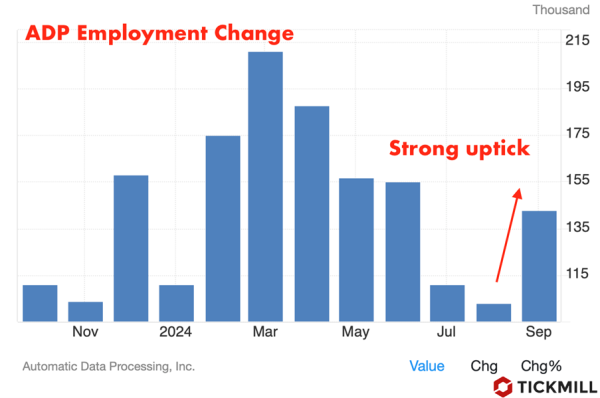

Private sector employment in the US rose by 143,000 jobs in September, according to the ADP report. The reading beat estimates helping USD to extend recovery ahead of the NFP release:

The EUR/USD pair also felt the impact of escalating geopolitical tensions in the Middle East. Reports emerged that Iran fired approximately 200 missiles, including ballistic types, at Israel's capital, Tel Aviv, in retaliation for the killing of Hasan Nasrallah, the head of the Iran-backed militia group Hezbollah.

Such developments heighten global uncertainty, prompting investors to seek safe-haven assets like the US Dollar and US Treasuries. The increase in demand for the Dollar adds additional upward pressure on the currency, further weighing on the EUR/USD pair.

Looking ahead, markets will closely monitor comments from Federal Reserve officials, including Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. Their insights could provide valuable clues about the Fed's policy trajectory amid mixed economic signals.