Market angst pushes volatility higher across the board – Volatility Watch

Euro/dollar volatility skyrockets as recession fears resurface

Volatility in commodities jumps as geopolitics takes centre stage

Stock indices experience much stronger volatility, decoupling from Bitcoin

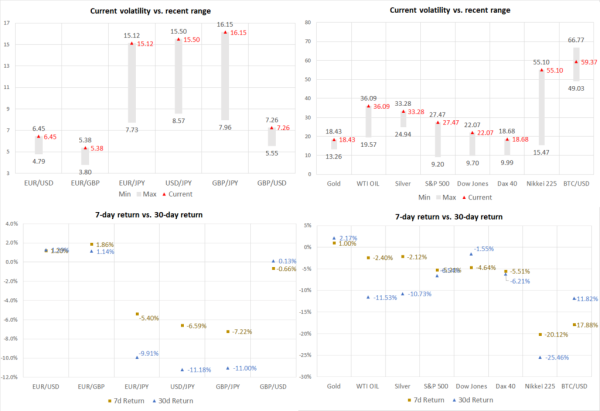

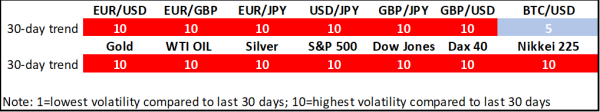

Volatility in the main FX pairs, including euro/dollar, jumped to the highest level of the past month as fears of recession, on the back of last Friday’s weak US labour market report, resulted in the market pricing in an aggressive easing path for most central banks during 2024. Yen pairs continue to attract extra interest as dollar/yen has quickly lost more than 10% in just 20 sessions.

In the meantime, volatility in commodities has jumped to the highest level of the past 30 days, on the back of the ongoing dollar weakness and geopolitics, particularly the latest Middle East developments, taking centre stage and resulting in a muted risk-off market reaction.

The US stock market has taken a leading role in the current market correction, pushing stock indices' volatility to the highest level of the past month as equity investors suddenly got extremely worried about the possibility of a US recession in 2024.

Finally, a very strong double digit price drop in Bitcoin failed to push volatility higher.