Market Volatility Boosts US Dollar, EUR/USD Breaks Key Support

The EUR/USD was under pressure last week following the release of US inflation data and amid escalating tensions in the Middle East.

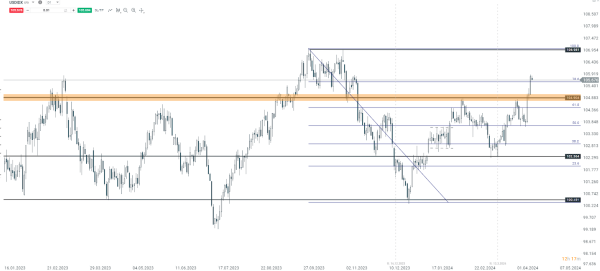

The increase in market volatility, resulting in a sell-off in indices, ultimately benefited the US dollar, which extended its gains from recent weeks.

Consequently, the EUR/USD broke below the support zone that had been sustaining the price since November 2023.

At this moment, as long as the price remains below the 1.072 level, a bearish scenario seems most likely, and the possibility of a further decline towards the support level at 1.055 should not be ruled out.

EUR/USD Daily time frame chart. Source: xStation 5

Dollar Index, Daily time frame chart. Source: xStation 5

Forex Heatmap. Source: xStation 5

Henrique Tomé,

Analyst Portugal