Meta Platforms ahead of Q2 2024 earnings📊 What to expect?🔎

Technology and media giant Meta Platforms (META.US, formerly Facebook) will report Q2 2024 today. Investors will pay attention to the health of the advertising segment, the demand for and impact of new AI products, and the company's margins, in the context of high CAPEX. The company raised its annual capital spending forecast for 2024 to $35-40 billion (total CAPEX of $96-99 billion). In Q1, the company slightly beat revenue expectations and clearly (by nearly 10%) expected earnings per share. Nevertheless, the stock cheapened by nearly 16% after the Q1 results. Will this be the case this time as well, and will the company raise its forecasts?

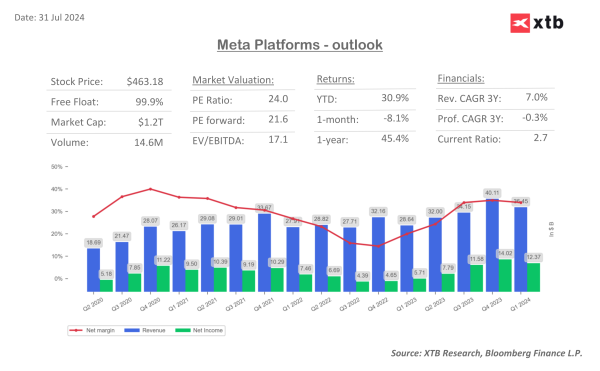

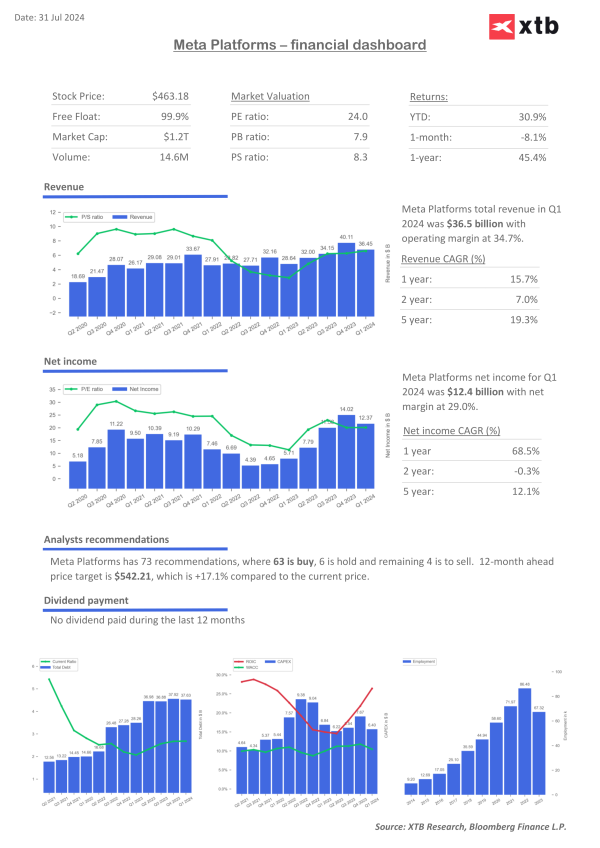

Estimated revenues: $38.29 billion vs. $36.46 billion in Q1 2024

Earnings per share (EPS): $4.70 vs. $2.98 in Q1 2024 ($12.32 billion vs. $7.79 billion in net income)

Estimated operating loss for Reality Labs: (Metaverse, VR/AR): $4.31 billion

Meta estimated Q2 2024 revenue of $36.5 billion to $39 billion. The midpoint of that range, or $37.75 billion, would yield 18% y/y. Wall Street, however, has an appetite for more and is hoping for 20% revenue growth. A big catalyst for the company's business could include the second half of this year if the TikTok ban in the US actually goes into effect, forcing many advertisers to sign contracts with Meta. It is uncertain, however, whether Meta will address the issue in any way, in the report, as it's possible related to US presidential election result (Trump against the TikTok ban).

Business and AI

The market will turn its attention to how and at what scale the application of AI translates into business. In Q1, Instagram Reels suggested suggestions based on artificial intelligence led to an 8-10% increase in time spent watching videos (and ads). Investors will also be awaiting comments on how the Llama 3 model will translate into progress in building so-called 'virtual worlds,' as Mark Zuckerberg recently announced.

- In Q1 2024, the company conveyed that it had bought about 600,000 H100 chips from Nvidia; also, the semiconductor market will await whether the company has bought additional chips from Nvidia, in Q2. The lack of purchases may suggest a lower appetite for costly AI investments.

- According to Citi as well as Wells Fargo, the ad market globally is in healthy shape and showed signs of improvement in Q2, which should be felt first by Meta

- Wells Fargo expects Meta to maintain its capital spending forecast of $35 billion to $40 billion for 2024.

- Mizuho Securities was optimistic about Meta's valuation, given Wall Street's 'caution' somewhat 'scared' by the scale of the company's investments (the prospect of their profitability is still uncertain, after all).

- Analysts also hope to see an increase in revenue from licensing the Llama model to corporations and the adoption of subscription offerings of 'chatbot AI' tools, similar to OpenAI and Gemini

Ads - in focus on Wall Street

Advertising revenues in Q1 were up 27% y/y. This time, however, the 'base effect' will be somewhat less favorable. Analysts at Citi expect ad revenues to rise 20.5% y/y to $37.95 billion. Reasons include improving ad health, Instagram Reels and new solutions for advertisers, including AI.

- Wedbush analysts indicated that most advertisers plan to increase or maintain spending on Meta ads. This could contribute to good results in the second quarter and improve sentiment, for the second half of the year.

- According to JP Morgan, the open-source AI language model Llama 3.1. could make Meta AI “the most widely used AI assistant by the end of the year, if not sooner.”

- Bloomberg Intelligence expects the consensus 20% ad revenue growth in Q2 2024 to be exceeded; Mizuho Securities is of a similar view, with analysts pointing to Amazon's integration with Facebook and Reels' ad price increases, suggesting increased profitability and strong demand

- Wall Street's attention will also wander to legal costs; the company may also see benefits from the TikTok ban in Q1 2025 (a hike by advertisers in Q2 2024.

- Investors in Meta's report will be looking for evidence of how clearly increased spending on artificial intelligence investments will translate into growth in its business and its prospects in the coming quarters. Significantly, the company's headcount (about 69,300 in Q1 2024) declined by 10% y/y, which provides some additional 'relief' to free cash flow.

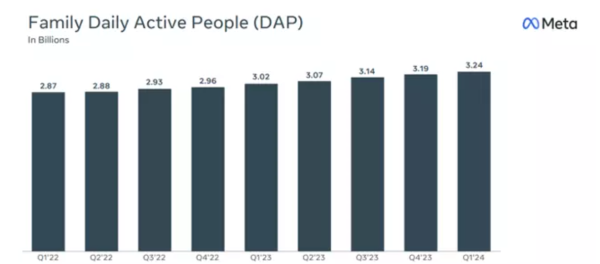

In Q1 2024, the number of Family Daily Active People (DAP) users averaged 3.24 billion in March 2024. Despite the large scale, this is a 7% year-on-year increase. The number of display ads increased 20% YoY, and the average ad price increased 6% YoY. Meta Platforms, IG

Meta Platforms (META.US, D1 interval) Source: xStation5

Source: xStation5

Meta Platforms financial dashboards

Looking at the forward p/e of 21, expectations look quite conservative compared to the other Big Tech companies. The growth rate of the company's return on invested capital (ROIC) is accelerating, giving bulls some hope for potentially sizable gains from the company's AI investments. At the same time, the weighted average cost of capital (WACC) has fallen noticeably recently, which also looks favourable for Meta.

Source: XTB Research, Bloomber Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.