Meta Q1 2024 earnings: conservative guidance results in a 12% decline

Meta reported relatively strong results for Q1 2024, exceeding market expectations in terms of EPS and total revenue, but presenting weaker results for Reality Labs, weaker operating profit for the app family and fairly conservative expectations for Q2, which are expected to be little changed from Q1. Here are the key points from today's report:

Positive aspects:

- Higher than expected EPS: $4.71 vs. $4.30 expected and $2.2 a year earlier

- Higher than estimated total revenue: USD 36.46 billion (+27% y/y) vs. USD 36.12 billion expected.

- Strong growth in advertising revenue: USD 35.64 billion (+27% y/y) vs. USD 35.57 billion expected

- Solid revenue from the app family (Facebook, Instagram, WhatsApp) vs. expectations: USD 36.02bn vs. USD 35.53bn

- Reality Labs' smaller-than-expected operating loss: USD 3.85bn vs. USD 4.51bn

Negative aspects:

- Reality Labs revenue lower than forecast: USD 440 million vs. USD 494.1 million

- Lower than estimated operating profit for app family: USD 17.66 billion vs. USD 17.76 billion

- Guidance for Q2 indicates revenue in the range of USD 36.5bn to USD 39.8bn. USD 38.24 billion was expected

The results show that Meta's core business - the advertising segment - is performing well, although the beating of expectations was not very big either, but at the same time the year-on-year growth is very strong. However, the weaker performance of Reality Labs and the mixed news on social apps and the more cautious forecast for Q2 2024 did not please investors, resulting in a 12% decrease in the stock price in after-hours trading. It is also worth mentioning that this is the first report without showing monthly and daily active users. Instead, the company shows results for its family of apps, which includes Instagram and WhatsApp, among others.

The company also indicates that it expects higher capital expenditure this year, which is related to, among other things, the development of services related to artificial intelligence. The range of spending for 2024 has been raised from a range of USD 30-37 billion to USD 35-40 billion. The company has previously boasted of new AI products to boost advertising revenues. The company is also introducing AI features such as a chat assistant, which is expected to lead to increased user engagement in apps.

It is worth waiting for management's statements during the post-earnings conference call to find out the reasons behind the rather conservative outlook for next quarter. So far in the results, investors did not get any information on how the investments made in AI are expected to pay off.

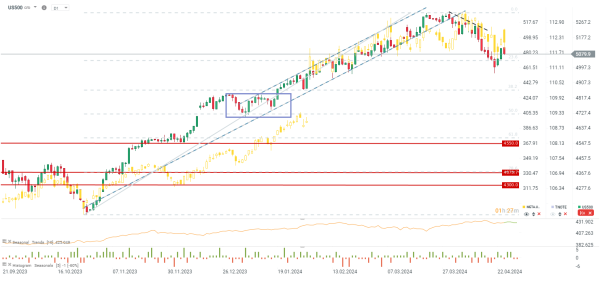

The company's shares are already losing almost 12% in after-hours trading and could open tomorrow around where they were before the Q4 2023 report was published. US500 loses after Meta's results. Source: xStation5