Meyer Burger: A new day dawns for the solar specialists

As Meyer Burger turns 70 this year, the small-cap stock is enjoying a moment in the Sun just in time for its milestone birthday. Its transformation from mechanical engineering firm to a manufacturer of high-quality photovoltaic cells and modules could pay off. Read on to learn more about Meyer Burger’s history and its plans for the future. Anyone who sees an opportunity in the company’s earnings date will find the right instruments on Swiss DOTS, Switzerland’s leading OTC marketplace for leveraged securities.

In 1953, Hans Meyer and Erich Burger joined forces to establish a company that initially acted as a supplier to one of Switzerland’s most important industries. Meyer Burger built machines designed to manufacture jewel bearings for watches. It marked the start of an eventful history full of both twists and turns and highs and lows. The Thun-based company then turned its attention to cutting silicon wafers for the semiconductor industry in 1970, before discovering photovoltaics (PV) in the 1980s. Meyer Burger has remained committed to this sector ever since.

In the second half of the 2010s, Germany’s leading solar module manufacturers began losing ground to competitors from China, with the downfall of prominent corporations like Solarworld also casting a long shadow over Meyer Burger.

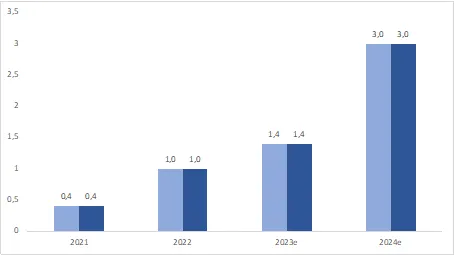

This eventually prompted management to pull the ripcord in 2020. CEO Gunter Erfurt and his leadership team initiated a change in strategy and announced their plans to “transition from being an equipment supplier to a manufacturer of highly-efficient solar cells and modules”. The company disposed of its peripheral activities while adding significant capacity in its new core business. Meyer Burger aims to produce PV modules and cells with a total nominal output of 1.4 gigawatts (GW) during the current year. This would represent a 3.5-fold increase in the company’s manufacturing output compared to 2021, with capacity set to soar further over the coming year (see chart).

The company claims to produce “the world’s most efficient PV module with the highest energy input per square metre”. Final assembly of these panels takes place in Freiberg using solar cells manufactured by the company in Bitterfeld-Wolfen. Meyer Burger’s sites in Germany provide an alternative to the mass production of PV systems in China. The Group operates an additional solar module production facility in Goodyear, Arizona, USA.

Meyer Burger has made an energetic start to its 70th birthday year in both an operational and a figurative sense, with the small cap also enjoying a moment in the Sun on the stock markets. The value of the stock has soared by more than 25% since Easter 2022, with the share price almost tripling compared to last year’s low. In addition to its own activities, the general mood of optimism within the sector also helped drive Meyer Burger’s rebound.

Solar power plays a vital role in both the fight against climate change and the global transition to renewable energy sources. The sharp fall in the cost of producing electricity is helping in this regard, and it has been some time since PV has had to fear comparisons with fossil fuels.

Then there are the political initiatives. The European Union reacted to Russia’s invasion of Ukraine by unveiling its RePowerEU plan. Among other targets, Brussels is seeking to double PV output by 2025, and install 600 GW of capacity across the EU by 2030. US President Joe Biden also gave the Thun-based company something of an early birthday present when he signed the Inflation Reduction Act (IRA) into law last August. This package of legislation provides significant support for the PV industry across the United States.

Just a few days after the IRA came into force, Meyer Burger managed to secure a lucrative order in the USA. D. E. Shaw Renewable Investments (DESRI) will source solar modules with a service capacity of at least 3.75 GW over five years from 2024 onwards. This developer, owner and operator of renewable energy projects also has the option to increase its order to as much as 5 GW. “DESRI will pay a substantial down payment each year to ensure that Meyer Burger can procure and finance the materials and commodities required for solar module production,” the company explained.

Of course, these funds will not be enough in themselves to cover the finances required for the company’s transformation. Last November, the company successfully carried out a capital increase, generating a quarter of a million Swiss francs in gross proceeds by issuing more than 926 million new shares. The company has also raised debt capital on a large scale. While the capital increase diluted the company’s existing shareholders, the loans it has taken out have added to its mountain of debt. As of mid-2022, non-current liabilities totalled almost CHF 213 million — around 15% more than at the end of the previous year.

If Meyer Burger is to shake off this heavy debt burden, particularly at a time of rising interest rates, it needs to complete its turnaround as quickly as possible. Although the company’s 2022 results have not yet been published, the next set of financial statements are likely to take the accumulated loss over the past five years beyond the CHF 300 million mark, to say nothing of the outflow of funds that has likely strained liquidity even further. Analysts are confident that the group will pull off its turnaround as early as the current year, with consensus currently positive for both earnings per share and cash flow.

Meyer Burger received something of an accolade from Goldman Sachs in February when the US bank commenced its coverage of the small cap stock with a Buy rating. The analysts’ arguments for this positive recommendation included the IRA package of legislation in the US as well as the EU’s RePowerEU plan. According to Goldman Sachs, PV installations in both markets could roughly treble over the next five years.

Meyer Burger significantly increases sales in 2022 and announces further growth in production capacity with new long-term offtake agreements in the United States. On Swiss DOTS, investors can find the right instruments to invest in the company. Instruments such as the Mini-Future (Valor 125036559) allow investors to take a long position. The knockout threshold for this note at BNP Paribas is currently 6.6% below the strike price. Alongside other parameters, this configuration results in a leverage of 6.7. The acceleration factor drops considerably to 4.4 with an additional Long Mini-Future (Valor 124662671).

At present, only UBS offers short securities in Meyer Burger on Swiss DOTS. This issuer allows investors to speculate on falling prices with instruments such as the Mini-Future (Valor 123971489). While the leverage here is around 7.4, the ratio for another instrument (Valor 125297034) is “only” 4.6. The same principle applies to every variant: if the underlying calculation does not come off, heavy losses await. Even 70 years of company history and a continuing share price rally do nothing to alter the fact that clouds could gather over Meyer Burger again at any time.

Meyer Burger: installed production capacity

Meyer Burger shares: a double upward breakout

(in CHF)

Swiss DOTS is the leading Swiss OTC platform for leveraged products. The Meyer Burger derivatives presented here are just some of more than 90'000 ideas you can trade affordably between 08:00 and 22:00 each day from CHF 9.00 flat/trade.