Microsoft loses nearly 7% after 4Q23/24 earnings release 📊

Microsoft 4Q23/24 results turned out to be mostly in line with market consensus forecasts. However, for the leading technology companies that have been the main driver of the bull market for many months, implicit in investors' expectations is the belief that major players must beat forecasts, especially in key segments. Heated expectations and the lack of a positive surprise resulted in the company's shares falling nearly 7% in after-hours trading.

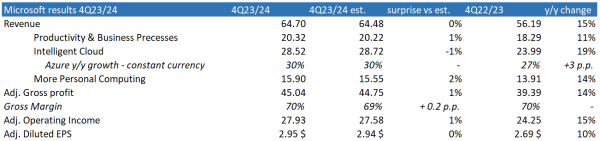

Microsoft reported $64.7 billion revenue, a year-on-year increase of 15%. Among the individual segments, cloud services sales were the best performer, rising 19% year-on-year to $28.52 billion. The most important component of this segment is, of course, Azure revenue, which most strongly reflects trends in AI. For this segment, growth was 30% year-on-year in constant currency terms. While this growth rate remains higher than that of rival Alphabet, it is this figure that most likely disappointed investors, who expected an even higher growth rate than forecast. Earlier, Microsoft announced that it expected a growth rate of 30-31% in this segment.

In the More Personal Computing segment, the company reported a strong 14% y/y increase to $15.9 billion. Great dynamics was reported in the Xbox segment, which grew 61% year-on-year. However, in this case, the driver of growth is primarily the Activision acquisition, hence we can't talk about such strong organic growth here.

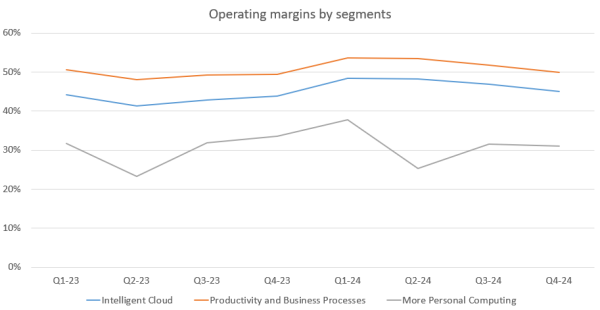

The company achieved an operating profit of $27.93 billion, which is 15% higher than a year earlier. The cost growth rate for Microsoft remains very close to the revenue growth rate, hence no significant improvement can be seen at the margin level. A possible negative sign could be the deterioration this quarter of the operating margin in the Intelligent Cloud segment, which reached 45%, the lowest in all of 2024.

At the diluted EPS level, the company presented $2.95, which is in line with analysts' forecasts and represents a 10% year-on-year increase.

Microsoft's results are solid and do not surprise, but with the market heating up and huge expectations, the market reads the lack of surprise as a negative signal. Technology companies have become accustomed to investors being able to beat forecasts on a regular basis, leaving room to keep raising them for future quarters. This time, however, Microsoft is bringing those expectations down to earth, and as a result, it is trading at a strong discount in post-close trading.

Microsoft's results in $ billion (excluding EPS). Source: XTB Research, Microsoft

Q4 operating margins in the two major segments (Intelligent Cloud: 45%, Productivity and Business Processes: 50%) recorded the lowest values in all of 2024. Source: XTB Research, Microsoft

Microsoft's stock fell in after-hours trading to its lowest value since April this year. Source: xStation

Microsoft's stock fell in after-hours trading to its lowest value since April this year. Source: xStation