Microsoft raises dividend and authorizes new share buyback plan

Microsoft has decided to make updates to its policy of sharing profits with its shareholders. The dividend increase and the new share buyback program are laying the groundwork for investors focused on a more long-term approach to the company's valuation to revise their expectations.

The first major change is the dividend increase. The company declared a quarterly dividend of $0.83/share. This is an increase of 10.7% compared to the previous dividend. The company has been increasing its dividend payments continuously since 2016, with the average dividend increase over the past eight years being 10.4% and the median 10%. Investors can thus feel satisfied, as the payout growth rate is slightly above average.

Nevertheless, from the perspective of Microsoft's price movements, the increase has not kept pace with the company's rapidly rising market valuation. The forward dividend yield (calculated assuming the quarterly dividend is maintained at the new level) is 0.77%, which is 17 bps lower than the company's five-year averages, and more than double the sector average.

The company also announced a new share repurchase program, for which it wants to allocate $60 bln, the same value as the one started in 2021. This implies a share repurchase rate of around 0.93%, compared to 0.47% last year.

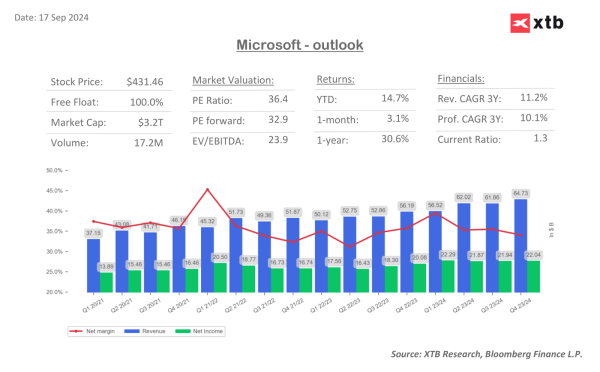

Microsoft's stock price is up nearly 2% in response to the update on its share buyback plan and dividend hike. Source: xStation