MicroStrategy gains more than 5.3% premarket as Bitcoin soars

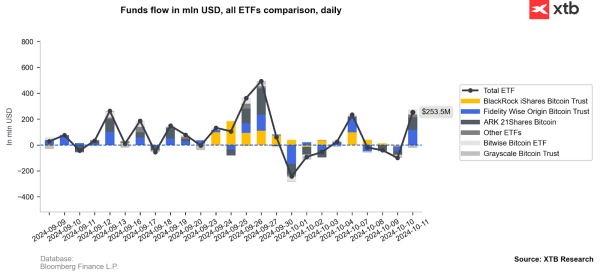

MicroStrategy extended gains, rising 5% in premarket trading as Bitcoin approaches key resistance. The positive sentiment is supported by inflows into spot Bitcoin ETFs, with Friday’s data showing net inflows of $253 million, matching last Monday's levels. ETFs now hold $18.4 billion worth of Bitcoin.

Bitcoin's price action shows bullish divergence on both the MACD and RSI, with the MACD issuing a buy signal and the RSI breaking above 55. Key resistance for Bitcoin is set at the 78.6% Fibonacci retracement, and if broken, a retest of the $69,900 all-time high could follow. For bears, the resistance must hold, and the 61.8% Fibonacci retracement level should serve as a key point to initiate a divergence.

Source: xStation

MicroStrategy's premarket surge is closely tied to Bitcoin's bullish momentum, but the company's unique position amplifies its gains. As a corporate Bitcoin holder, MicroStrategy offers investors leveraged exposure to the cryptocurrency's price movements. This "Bitcoin proxy" status has resulted in MicroStrategy trading at a significant premium to its Bitcoin holdings, reflecting factors such as investor confidence in CEO Michael Saylor's execution, the potential for future Bitcoin acquisitions, and the stock's accessibility for institutional investors who may face restrictions on direct cryptocurrency investments. The stock's recent gains outpace Bitcoin's movement, highlighting the leveraged exposure MicroStrategy provides to cryptocurrency price action. This amplified effect is further explained by the significant Net Asset Value (NAV) premium.

This premium encapsulates several key factors that investors are willing to pay for:

- Management expertise: There's strong confidence in Michael Saylor and his team's ability to execute their Bitcoin strategy effectively.

- Financial engineering: MicroStrategy's sophisticated use of convertible notes and other instruments to fund Bitcoin purchases adds value beyond simple ownership.

- Future value creation: Investors anticipate that MicroStrategy will leverage its Bitcoin-backed balance sheet for additional value creation, possibly through strategic acquisitions or expansion into blockchain-related areas.

- Accessibility: The stock offers a more convenient and liquid way to gain Bitcoin exposure, especially for institutional investors facing regulatory constraints on direct cryptocurrency investments.

As Bitcoin approaches key resistance levels and ETF inflows remain robust, MicroStrategy's stock benefits both from the appreciation of its Bitcoin assets and the market's positive outlook on the company's cryptocurrency-focused strategy. However, this premium also prices in the associated risks, including regulatory challenges and the need to balance the Bitcoin strategy with core operations. As the cryptocurrency market evolves, MicroStrategy's NAV premium may fluctuate based on the company's execution and broader market perceptions of its innovative approach to Bitcoin investment.

As MicroStrategy stock continues to soar, the next key level could be the all-time high at $333. Current support for bulls is set at the previous high of $199.9, which may act as crucial support for the oscillators to cool down. On the weekly time frame, both MACD and RSI have recently signaled a potential buy. However, on the daily chart, both indicators are approaching overbought territory. Caution is advised, as a pullback could be healthy given the rapid price movement.

Source: xStation