MicroStrategy Share Price Gains 1,500% in 4-Years: These 3 Bitcoin Mining Stocks Could Follow

MSTR Price Analysis:

On Friday Oct 25, Microstrategy (MSTR) stock price reached an all-time-high of $4,899, as Bitcoin’s recent price surge sparked positive speculations on MSTR stock price ahead of its Q3 earnings call.

Microstrategy share price has increased 1,600%, since founder Michael Saylor adopted a ‘Bitcoin acquisition strategy in 2020.

As MSTR’s remarkable Bitcoin-fueled performance draws Wall Street’s attention towards cryptocurrency sector, there has been further influx of capital towards the crypto mining sector, from investors seeking indirect exposure to BTC.

The market analysis below explores top 3 major Crypto Mining Stocks that could potentially mirror MicroStrategy’s quadruple-digit growth performance in the coming years.

MicroStrategy share price surges 1,500% 4-years after adopting Bitcoin strategy

On October 26th, 2024, Microstrategy (MSTR) share price rose to an all-time high of $4,899, just days before the IT firm’s Q3 earnings call scheduled for October 30.

A closer look at MSRT historical stock performance shows there’s has been a dramatic surge in price since adopting the famed ‘Bitcoin Strategy’ 4-years ago.

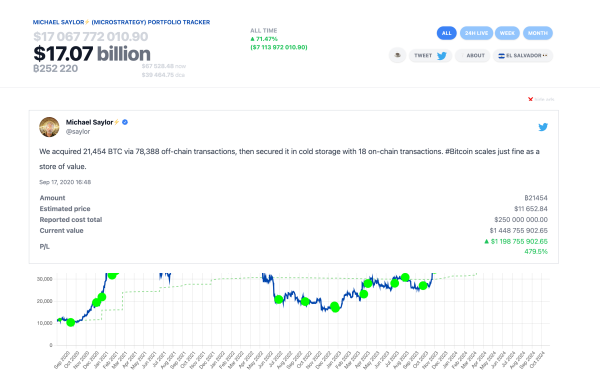

Michael Saylor announced the firm’s first Bitcoin purchase on Sept 17, 2020, acquiring 21,524 BTC at a cost price of $11.7 million.

Over the last 4-years the company has since acquired another 230,696 BTC, bringing its current Bitcoin holdings to $17 billion at the time of publication on Oct 27.

The price chart above emphasizes the positive impact of the Bitcoin strategy on MSRT share price trend in the last 4-years. Since Sept 17, 2020, MSTR share price has increased by 1,510%. Evidently, MicroStrategy’s uptrend closely mirrors BTC price which also increased by a remarkable 485% during that period.

After Micheal Saylor, other Wall Street big wigs like Larry Fink have also made multi-billion bets on Bitcoin, enhancing the allure of publicly-traded BTC mining stocks with significant exposure to the pioneer cryptocurrency.

3 High-Performing Crypto Mining Stocks to Watch

Crypto Mining Stocks sector is a grow sub-section of the equities market composed of firms engaged in the mining of BTC and other cryptocurrencies.

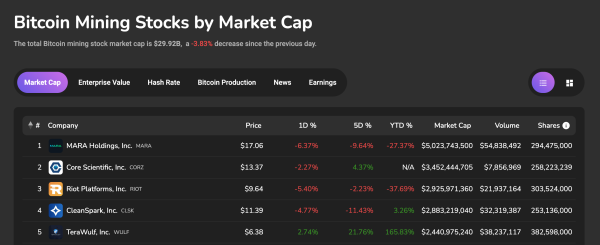

According to the latest data culled from BitcoinMining.io, the aggregate market capitalization of the sector has now reached $29.9 billion as of Oct 27.

Among the top 5 ranked Bitcoin mining stocks, three standout performers merit close attention: Marathon Digital Holdings (MARA), the largest BTC miner by market share; Riot Platforms (RIOT), pioneering the integration of AI and green energy into mining operations; and TerraWULF (WULF, the 2024 top performer with a remarkable 160% gain year-to-date.

1. Marathon Digital Holdings (MARA) October 2024 Market Cap, $5 Billion

Founded in 2010, Marathon Digital Holdings is a leading cryptocurrency mining company focused on Bitcoin. The company operates large-scale mining facilities across North America, positioning itself as one of the most efficient miners in the industry.

As of October 27, 2024, Marathon maintains its dominance in the crypto mining sector, boasting a market capitalization of over $5 billion, making it the largest publicly traded crypto mining stock by market cap. Despite its top spot, Marathon’s share price has faced significant headwinds this year, with a year-to-date decline of 27%.

This downturn reflects broader market volatility but also points to the company’s resilience, given its continued market leadership.

Marathon Digital Holdings (MARA) Fundamental Analysis:

The crypto market volatility and slow earnings after the Bitcoin halving have posed major challenges for MARA share price in 2024. However, as the sector’s largest company, Marathon’s operational scale and strategic positioning in the US market still offer a competitive edge.

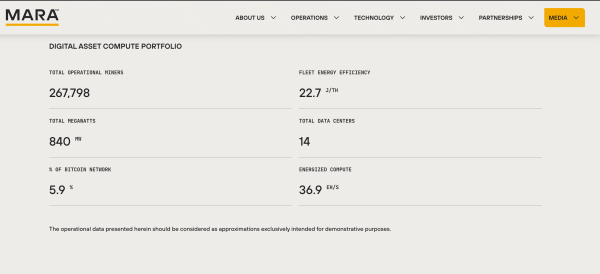

- Mining Capacity: Marathon operates one of the largest BTC mining fleets in the world, with 267,798 operational mining rigs, and total hash rate capacity exceeding 23 EH/s (exahashes per second).

- Bitcoin Holdings: As of the latest report, Marathon holds approximately 13,726 BTC, making it one of the largest corporate holders of Bitcoin.

- Revenue Generation: In Q3 2024, Marathon reported quarterly revenues of $81.4 million, underscoring its position as a top revenue generator in the sector.

The company’s commitment to expansion and efficiency improvements suggests it is well-positioned for potential gains as Bitcoin’s market prospects stabilize.

2. Riot Platforms (RIOT) October 2024 Market Cap, $2.9 Billion

Founded in 2017, Riot Platforms is a major player in the cryptocurrency mining sector, particularly focused on Bitcoin (BTC). With a commitment to sustainability, Riot has pioneered the integration of green energy solutions into its operations, positioning itself as an innovative leader in the industry.

As of October 27, 2024, Riot Platforms holds a market capitalization of $2.9 billion, making it one of the most prominent publicly traded mining companies. This year, Riot’s stock price has shown resilience amid market fluctuations in 2024, with a year-to-date increase of 12%.

Riot Platforms (RIOT) Fundamental Analysis:

The volatile crypto market and the financial impact of the recent Bitcoin halving have created challenging conditions for mining companies in 2024.

However, Riot’s focus on sustainable mining and strategic expansion has enabled it to maintain a competitive position, underscoring its commitment to innovation and operational efficiency. According to the firm’s recent Q3 2024 Earnings report, Riot has made significant steps towards expanding its mining capacity.

“On April 18, 2024 Riot announced the successful energization of the Corsicana Facility substation.

The Corsicana Facility will have a total capacity of 1 GW when fully developed, at which point it is expected to be the largest known Bitcoin mining facility in the world by developed capacity. ”

– RiotPlatform’s Q3 2024 Earning report.

- Mining Capacity: Riot operates one of the most advanced and sustainable BTC mining fleets globally, with a total hash rate capacity exceeding 17 EH/s (exahashes per second).

This expanded capacity is part of Riot’s goal to achieve carbon-neutral operations by 2025, which is critical in distinguishing itself in an increasingly competitive industry.

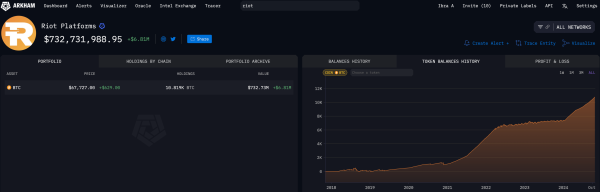

- Bitcoin Holdings: As of the latest report, Riot holds approximately 10,536 BTC, solidifying its position as a significant Bitcoin holder and demonstrating its strong cash reserves and operational success.

- Revenue Generation: Riot reported quarterly revenues of $71.3 million in Q3 2024, reflecting its robust revenue growth despite the challenging market environment.

This revenue generation underscores Riot’s efficiency and effective cost management, making it one of the top-performing companies in terms of profitability.

Riot’s commitment to sustainability and innovation through AI integration suggests a strategic vision that could deliver sustained growth as the Bitcoin market matures.

3. TeraWulf (WULF) October 2024 Market Cap, $2.4 Billion

Founded in 2021, TeraWulf focuses on sustainable Bitcoin mining by leveraging zero-carbon energy sources. The company emphasizes environmental responsibility and has made substantial strides in reducing its carbon footprint, positioning itself as a leader in sustainable cryptocurrency mining.

As of October 27, 2024, TeraWulf holds a market capitalization of $2.4 billion, reflecting the increasing investor interest in green crypto mining solutions. Despite market fluctuations, TeraWulf’s strategic focus on sustainability has driven its strong market positioning this year.

TeraWulf (WULF) Fundamental Analysis:

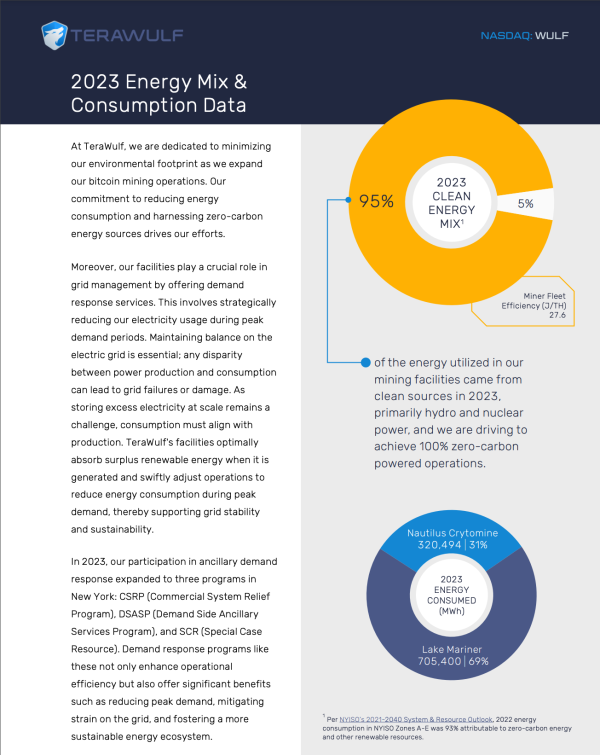

In 2023, TeraWulf successfully harnessed clean energy sources for 95% of its operations, setting a benchmark for environmentally friendly mining.

By participating in demand response programs, TeraWulf helps stabilize the grid by optimizing energy usage during peak demand, aligning its operations with environmental and regulatory expectations.

- Energy Mix and Consumption: TeraWulf’s fleet achieved a miner fleet efficiency rate of 27.6 J/TH, one of the industry’s highest efficiencies.

In 2023, TeraWulf’s mining facilities utilized 95% clean energy, primarily sourced from hydro and nuclear power, significantly lowering its environmental impact.

- Bitcoin Holdings: TeraWulf’s latest report shows it holds approximately 5,800 BTC, underscoring its strong position as an eco-conscious mining operator with considerable Bitcoin assets.

- Revenue Generation: For Q3 2024, TeraWulf reported revenues of $52 million, indicating robust growth driven by its sustainable operations and efficient energy management practices.

With its commitment to sustainable mining and participation in grid-stabilizing initiatives, TeraWulf is well-positioned to capitalize on the growing demand for environmentally responsible crypto mining as the industry seeks greener solutions.

Conclusion: MARA, RIOT, WULF, Could Mirror Microstrategy’s 1,500% Growth Performance

In summary, as MicroStrategy’s Bitcoin strategy fuelled its impressive 1,500% stock growth performance over the last 4 years, investor interest in cryptocurrencies has spread towards the crypto mining sector.

Marathon Digital Holdings, Riot Platforms, and TeraWulf stand out as high-potential players in the crypto mining industry, each showcasing distinct advantages that align with investor demands for scalability, innovation, and sustainability.

Marathon’s massive operational scale and Bitcoin holdings underscore its market leadership, while Riot’s focus on sustainable mining through green energy integration places it at the forefront of environmental responsibility.

Meanwhile, TeraWulf’s commitment to zero-carbon energy positions it as a key player in eco-conscious Bitcoin mining.

As institutional adoption of Bitcoin grows across the US, these 3 crypto mining companies could benefit immensely, potentially mirroring MicroStrategy’s quadruple-digit gains over the coming years.