Moneycontrol Pro Market Outlook | Nifty can touch a new high during the week

Dear Reader,

Indian markets ended the week with moderate gains as investors awaited the outcome of Federal Reserve Chair Jerome Powell's remarks at the Jackson Hole symposium on Friday night. Meanwhile, the Dow Jones Industrial Average and the S&P 500 Index edged closer to their record highs as the US markets responded positively to Powell's comments.

His statement, "The time has come for policy to adjust," fuelled optimism, suggesting that a 50-basis point cut, rather than the anticipated 25-basis point cut, might be on the horizon.

European markets also ended the week on a positive note, with the STOXX Europe 600 rising by 1.31 percent. Investors are optimistic that following the Federal Reserve's actions, the European Central Bank (ECB) may also cut interest rates next month. Among the top performers, Italy's FTSE MIB gained 1.83 percent, Germany's DAX rose by 1.70 percent, and France's CAC 40 was up by 1.71 percent. The UK's FTSE 100 Index posted a more modest gain of 0.20 percent.

In Japan, markets gained 0.8 percent amid hopes that the recent interest rate hike might prompt the Bank of Japan to hold off on further increases.

This week, the Chinese market saw a slight decline after the People's Bank of China decided to keep the lending rate unchanged.

Going forward, Indian markets are likely to open higher as they factor in the gains from the US market following Powell's speech.

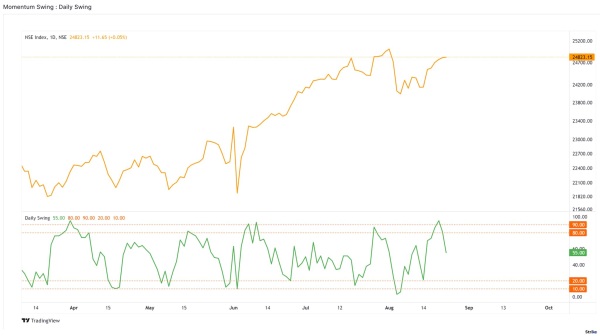

Positive momentum to continue

The Nifty closed positively for the second consecutive week and appears poised to reach new highs, as sentiment indicators are not signalling overbought conditions. This suggests there is still room for the Nifty to climb in the coming weeks before potential seasonal challenges arise from late September to October, which can be difficult, especially with the upcoming US elections. The market is expected to reach new highs, driven by positive momentum for now, although a corrective phase may emerge later as the US election outcome approaches.

The daily swing was high at 95 mid-week but cooled off to 56 by Friday (see chart Daily Swing). We are entering the expiry week with a low reading here. Nifty has seen seven consecutive days of gains, which may continue going forward and create a record run.

Daily Swing

Source: web.strike.money

Last week, we observed that the Open Interest-based Put/Call ratio had become relatively oversold, which was a bullish signal for the market. Interestingly, it lagged behind the market, meaning it was declining even as the market was rising, indicating a potential for further gains. Since then, the ratio has increased but has not yet entered the overbought territory (See chart Put/Call ratio). As we approach previous highs for this indicator, the market trend is expected to remain positive in the near term.

Put/Call ratio

Source: web.strike.money

Client positioning data reveals that, as a group, clients reduced their short positions over the last month and are now mildly long, holding a net bullish position of 34,000 contracts. The net position is calculated by subtracting the total long positions from the total short positions (see chart Client Position). As the market rises, this net position will likely return to the short side.

Client Position

Source: web.strike.money

Sector Rotation

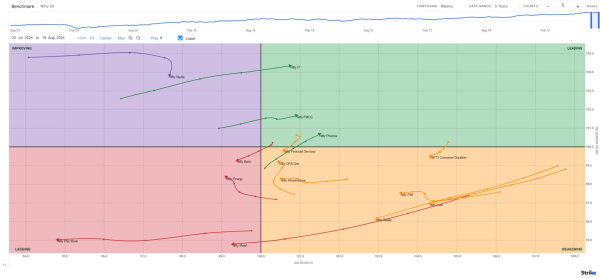

The Nifty IT index has entered the leading quadrant, as its relative strength ratio surpassed 100 this week on the Relative Rotation Graph (RRG) (see RRG Weekly chart) from India Charts. The Nifty FMCG and Nifty Pharma indices join it in the leading quadrant. Meanwhile, the Nifty PSU Bank and Nifty Metal indices are trailing as laggards.

RRG Weekly

Source: web.strike.money

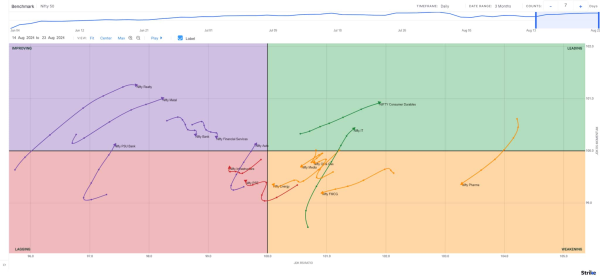

On the daily RRG, the Nifty IT index gained momentum and is back into the leading quadrant, indicating that it is now in the leading position on both the Daily and weekly timeframes.

Nifty Consumer durables continue to stretch in the leading quadrant, but Nifty Pharma lost momentum and fell into the weaking quadrant. Nifty FMCG continues to be in the weakening quadrant, but its leading position on the weekly timeframe makes it interesting.

Financial stocks were mostly flat and are still in the improving quadrant with slowing momentum. The Nifty Auto and PSU Bank gained relative momentum and are now in the improving quadrant.

Source: web.strike.money

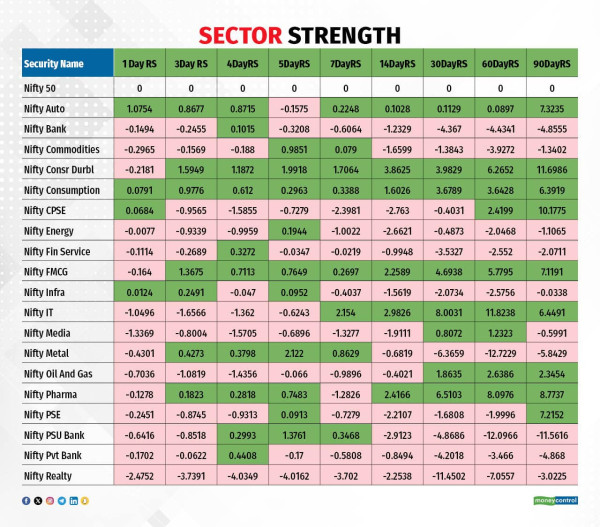

Data collated by Quant Lab shows that in the short term (7-14 days), Nifty Consumer Durables and Nifty Consumption have maintained their performance versus the Nifty index. These sectors have shown resilience and remain strong even while others show indications of weakening.

In the sector-vs-sector analysis (as seen in the table), Nifty IT shows strength, followed by Nifty Metals and Nifty PSU banks. However, the general market mood looks cautious, as several sectors show a minor performance decline.

Over the long run (up to 90 days), Nifty Pharma is a strong performer with the potential to maintain and expand on its gains. As the sector strengthens its position, it is expected to be an area of interest for investors looking for stability in the coming months.

Indices and Market Breadth

Indian indices closed higher, with the Sensex gaining 0.8 percent and the Nifty50 up one percent. However, action was also seen in the small cap space, which gained 4.42 percent, and mid-Cap stocks closed 3.70 percent up.

FIIs continued to be sellers during the week, with a net sale of Rs 1,607 crore, bringing their monthly sale figure to Rs 30,585.80 crore. In the derivative space, their position was flat, with an open interest of 25,617 contracts.

The top gainers in the derivative space during the week were PEL, which gained 11.10 percent, Voltas, which closed 10.12 percent higher, and Indigo, which was up 10.12 percent. Among the losers were Sun TV, down 6.38 percent, IGL, up 3.99 percent, and Oberoi Realty, which ended the week with a loss of 3.57 percent.

Stocks to watch

Among the stocks expected to perform better during the week are Coal India, ITC, HDFC AMC, SBI Life, Lupin, Marico, Alkem, BPCL, JSW Steel, Bharti Airtel, Jubilant Food, Shriram Finance and Cipla.

Among the stocks that can witness further weakness are IndusInd Bank and Shree Cement RBL Bank, IDFC First Bank, IndusInd Bank, IDFC and Shree Cement.

Cheers,

Shishir Asthana