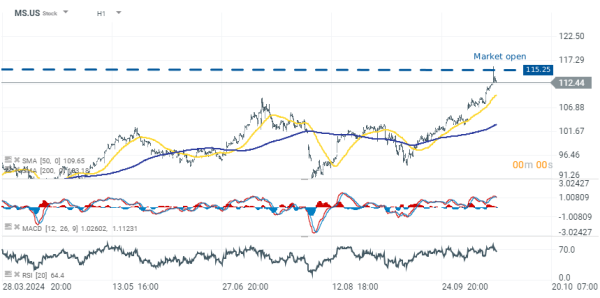

Morgan Stanley gains 2.70% driven by better-than-expected Q3 report 🎯

Morgan Stanley gains 2.70% to $115.25 after releasing a better-than-expected Q3 report.

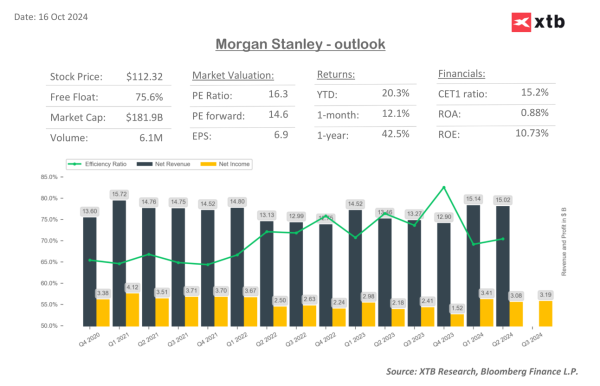

- Earnings per Share (EPS): $1.88, up 32% from $1.42 in Q3 2023.

- Revenue: $15.38 billion, a 16% increase from $13.3 billion in Q3 2023.

- Wealth Management Revenue: $7.27 billion, up 14% year-over-year.

- Investment Banking Revenue: $1.46 billion, a 56% increase from last year.

- Equity Trading Revenue: $3.05 billion, up 21% from $2.52 billion in Q3 2023.

- Fixed Income Revenue: $2 billion, up 3% year-over-year.

- Return on Tangible Common Equity (ROTCE): 17.5%.

Morgan Stanley exceeded analyst expectations for Q3 2024, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%. Strong trading activity and improved market conditions contributed to robust earnings, and shares rose by 3.8% following the release.

Wealth Management achieved record revenues of $7.3 billion, driven by increased client asset inflows and robust transactional revenues. The firm added $64 billion in net new assets, pushing total client assets to $6 trillion. Institutional Securities reported a 20% year-over-year revenue increase, largely due to strong trading in equities and fixed income.

Investment Management also saw growth, with a 9% increase in revenues to $1.46 billion, driven by higher assets under management (AUM) and positive net flows. CEO Ted Pick highlighted the firm’s capital generation and strong returns with a 17.5% return on tangible common equity (ROTCE) for the quarter.