Morning wrap (01.08.2024)

- Wall Street ended yesterday's session in positive sentiment. The Nasdaq gained 2.64% intraday, the S&P500 added 1.58% and the Russell 2000 gained 0.51%. The rally was fueled by technology companies, particularly Nvidia shares, where we saw more than 13% gains intraday.

- Optimism was further increased after the close of US trading, when very strong financial results were reported by companies such as Meta Platforms, Qualcomm, eBay and Arm Holdings.

- Meta Platforms reported strong financial results for the second quarter of 2024, beating analysts' expectations in both revenue and earnings per share (EPS). Mark Zuckerberg said Meta AI is on track to become the world's most popular AI assistant by the end of 2024.

- The Fed kept interest rates unchanged and is not clearly pointing to a rate cut in September, stressing that more signs of inflation falling to target are needed

- Powell, however, was decidedly more dovish during the conference and announced the possibility of a cut in September if data warranted it

- China's Caixin Manufacturing PMI reading for July 2024 came in at 49.8 (51.5 was expected, 51.8 previously)

- Japan: July Manufacturing PMI (final): 49.1 (previously 50.0)

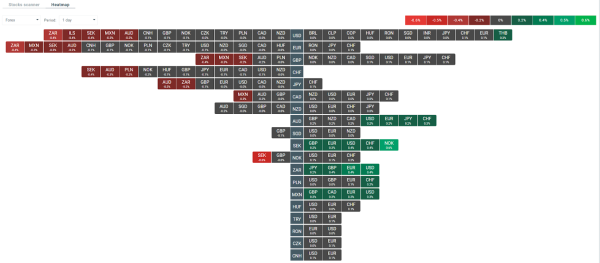

- USD/JPY and the yen cross rates saw another day of wide fluctuations following Wednesday's Bank of Japan decision to raise interest rates and signals from the U.S. Federal Reserve that a rate cut is imminent.

- From a level above 150 in the morning, the USD/JPY pair fell to around 148.50, before recovering to around 149.80 at the time of writing this commentary.The USD/JPY pair is now down to around 148.50.

- Crude oil continues its strong gains, linked to the geopolitical situation. Ismail Haniyeh, head of Hamas' political wing and a key negotiator in ceasefire talks with Israel, was killed in Tehran, Iran, while attending the inauguration of Iran's new president. A few hours earlier, Fuad Shukr, Hezbollah's second-in-command, was targeted by a rocket attack in Beirut, Lebanon. Although no one claimed responsibility for the attacks, the identities of senior commanders of Iranian allies-caused the blame to be quickly placed on Israel. In response, Iran's leader was said to have ordered “direct” retaliation against Israel.

- Gold remains in the zone of historical highs and is trading in the zone of $2445 per ounce.

- In the cryptocurrency market, we observe a further retreat of Bitcoin prices below $64 200.

Heatmap of volatility observed in the FX market at the moment. Source: xStation 5