Morning wrap (06.08.2024)

- Yesterday's session on Wall Street and European markets saw a sizable bump in the quotations of the various indices. The Nasdaq lost 3.43% at the close, the S&P500 was down 3%, the German DAX lost 1.82%, and the French CAC40 lost nearly 1.42%.

- In the afternoon hours, however, the scale of the sell-off weakened. This was largely related to the higher-than-expected reading of ISM data for the US service sector.

- Today in Asia we are seeing a marked improvement in investor sentiment. Japan's Nikkei is currently gaining 8.38% on the spot market, while Korea's KOSPI is up nearly 3.1%.

- After Monday's plunge in Japan's Nikkei, today was a case study of a " 360-degree turnaround." The Nikkei 225 skyrocketed as soon as the cash market opened, so much so that a trading pause was announced after the opening surge in futures. The yen fell and the USD/JPY exchange rate rose to around 146.50 before resuming declines in the latter part of the session.

- A better session in Asia today also propelled futures based on European and US indices. Futures based on the German Dax are currently gaining 0.5%, while those based on the US Nasdaq index have added 1.6%.

- The most important event of the day in APAC markets was the RBA's decision on interest rates. As expected, the Bank of Australia kept rates unchanged at 4.35%. The bank reiterated its comment on the persistence of inflation and added that all options within the bank's causal mandate are on the table at a future Council meeting. The AUD is currently leading gains in the broad FX market.

- Fed’s Daly (voter) said none of the labour market indicators she looks at are flashing red right now but she is monitoring them carefully and said the Fed is prepared to act as it gets more information.

- Kamala Harris has officially become the Democratic candidate for President of the United States.

- Japanese Secretary of State Hayashi says wage increases in Japan will be widespread.

- In commodity markets, we are not seeing much price movement at this point. WTI crude oil and NATGAS are trading slightly higher, nevertheless the magnitude of the movements does not exceed 0.6%.

- Bitcoin is recovering from yesterday's session and is gaining nearly 2% today. Thus, the cryptocurrency is trading above the $55,000 zone.

- The VIX fear index is slipping more than 7.8% today.

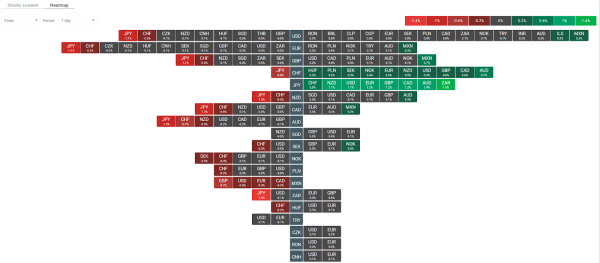

Heatmap of the volatility observed in the FX market today. Source: xStation