Morning Wrap (07.10.2024)

- Friday's session on Wall Street ended with gains for most stock indices. The Nasdaq gained 1.22%, while the S&P500 added 0.9% and the Russell 2000 1.5%. The main driver of these moves was much higher-than-expected NFP data, which reduced fears of a recession in the US economy.

- After the weekend, Chinese markets are still closed, nevertheless tomorrow Golden Week will come to an end and trading will resume on mainland Chinese indices. Nonetheless, the Hang Seng, which is trading normally and extends today's wave of gains, adding more than 1.5%.

- The PBoC establishment's next conferences are also scheduled for tomorrow, which will consider how to implement further stimulus tools for the Chinese economy in the long term.

- At the same time, other Asian indexes are also rising. Japan's Nikkei is adding 2.4%, Korea's KOSPI is up 1.5% and Australia's ASX200 is adding 0.7%.

- Goldman Sachs raised its recommendation for Chinese stocks to “overweight.”

- The economic calendar for today is very light. However, investors may pay attention to data on German factory orders, Eurozone retail sales and speeches by the Fed's Bowman and Kashakri.

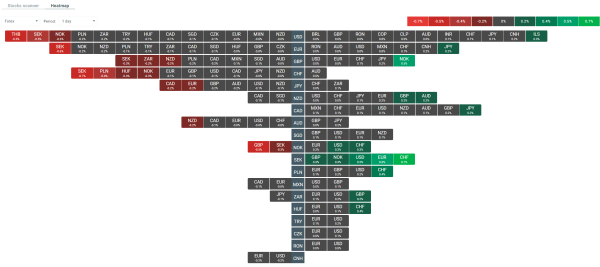

- In the broad currency market, the Australian dollar and the Japanese yen are currently the best performers. However, the Canadian dollar and the euro are trading under pressure.

- The DXY (dollar index) held on to most of Friday's post-NFP gains, EUR/USD remains at 1.09, and USD/JPY briefly crossed the 149 level overnight, but fell out of the zone after verbal comments from Japanese Finance Ministry Deputy Minister for International Affairs Atsushi Mimura.

- The banker added that Japanese policymakers will closely monitor movements in the foreign exchange market, including speculative trading.

- The commodity market is dominated by declines today. Natural gas is currently losing more than 1.2%, while gold and oil are down 0.32% and 0.48%, respectively.

- In contrast, we see a slightly broader rebound in the crypto market, where Bitcoin is up more than 2%. At the same time, Ethereum is gaining more than 3%.

Volatility currently observed in the foreign exchange market. Source: xStation