Morning Wrap (16.10.2024)

- Asian stocks mostly gained, led by Hong Kong's Hang Seng and China's CHN.cash both more than 2.5% higher. Japan's Nikkei 225 was 0.6% higher with AU200 being the worst performing (+0.13%)

- European indices are set for mixed opening, with DAX 40 being 0.1% lower at the time of writing. US indices are green in premarket with Nasdaq leading gains (+0.24%).

- US warns Israel of potential halt to arms transfers if Gaza aid is not distributed.

- New Zealand's Q3 CPI rose 0.6% quarter-on-quarter, slightly below expectations of 0.7%. Annual inflation slowed sharply to 2.2%, returning to the central bank's target band for the first time in over three years.

- Oil prices inched lower after steep losses in the previous session. Brent crude slid 0.4% to $74.43 a barrel, while WTI crude decreased 0.4% to $70.8 a barrel. Concerns about an escalation in the Israel-Hezbollah conflict persist.

- Bank of Japan policymaker Seiji Adachi urged a "very moderate" pace for interest rate hikes, warning of potential headwinds from yen appreciation and slowing global demand.

- ASML provided a weak sales forecast for 2025, causing a selloff in global chip stocks. The Dutch company's U.S. shares plunged 16% overnight, dragging down other tech giants like NVIDIA (-4.7%).

- Luxury giant LVMH reported a 3% fall in Q3 sales, its first decline since the pandemic, as demand weakened in China and Japan. The news is likely to impact other luxury stocks.

- Hong Kong's leader John Lee announced measures to boost the economy, including reforms to reduce public housing wait times and efforts to attract more international company listings.

- Cryptocurrency markets opened higher, with Bitcoin up 1.1% to $67,000 and Ether gaining 1.2% to $2,609.12.

- Gold prices edged up 0.2% to $2,667.75 an ounce, while focus remains on geopolitical tensions in the Middle East.

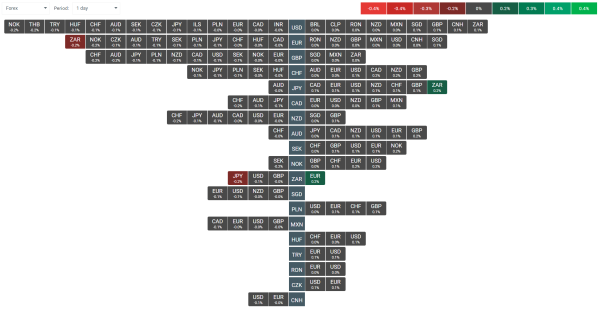

- EURUSD is down 0.05%, silver has gained 0.46% and platinum is up 1.2%

FX heatmap Source: xStation