Nasdaq 100 braces for a huge US data week - Stock Markets

- Nasdaq 100 loses some ground after six-week bullish streak

- Magnificent Seven report earnings, US data to adjust rate cut estimates

Nasdaq 100 Weekly Performance

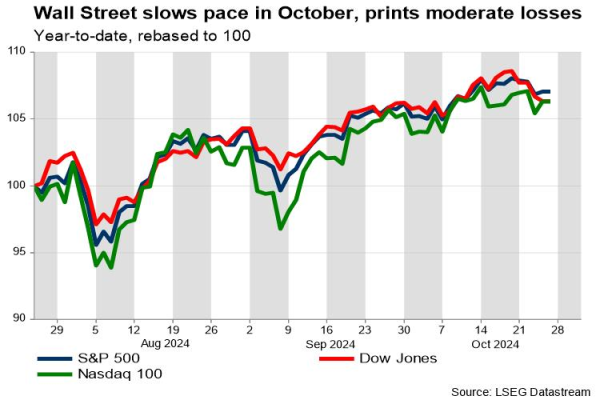

The Nasdaq 100 is set to finish the week mildly lower by 0.46%, breaking a six-week non-stop rally as with the other major US indices. Despite flying back above the 20,000 level though, it could not surpass July’s all-time high of 20,690, raising speculation about whether the slight technical pullback could develop into something uglier.

The truth is that news on the AI front has been mixed so far this month, with double digit declines in the covid-vaccine manufacturer Moderna and the semiconductors ASML and KLA offsetting gains in Nvidia, Marvel Technology, Atlassian and Super Micro Computer. Volatility, however, could still heat up in the last trading week of October as traditional US tech behemoths will report their earnings, while key economic data could prompt a reassessment of rate cut expectations.

Earnings Bonanza

Next week promises an exciting earnings schedule as the "Magnificent Seven" prepare to release their financial results for the three months to September. The lineup kicks off with Alphabet (Google's parent) on Tuesday, followed by Microsoft and Meta Platforms (formerly Facebook) on Wednesday, and wrapping up with Amazon and Apple on Thursday.

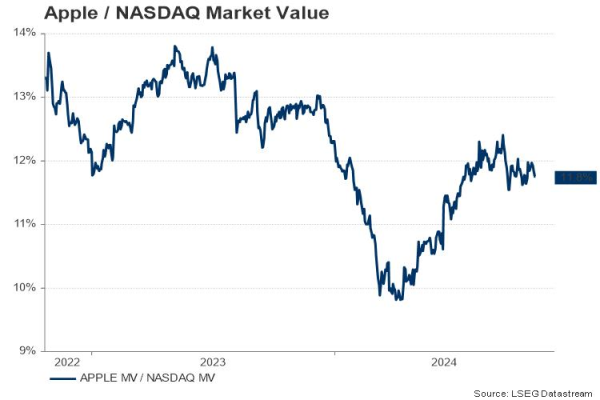

Apple has the largest weight along with Nvidia in the Nasdaq 100 community. Hence, any surprises there may have a bigger impact on the index. The company will report its final statement for the 2024 fiscal year ending September, with analysts estimating a 10% quarterly increase and a 5.5% annual growth in revenue to $94.4 billion.

However, concerns linger over declining iPhone revenue for a second consecutive year, amidst stiff competition and potential tariffs under a Trump presidency. Investors will be keenly watching Apple’s guidance for insights on future performance.

As regards its new product releases, Apple could make several announcements on the hardware front next week, though those who wait for the advanced M4 update of the MacBook Air might have to wait till the first quarter of 2025.

It’s worthy to note that the large portfolio concentration in big-cap companies such as Nvidia, Apple, Amazon, Microsoft, Alphabet , and Meta, raised regulatory alarms recently, with the IRS mandating strategic investment companies such as Fidelity to comply with the 50% allocation limit.

Key Economic Data Set to Impact Markets

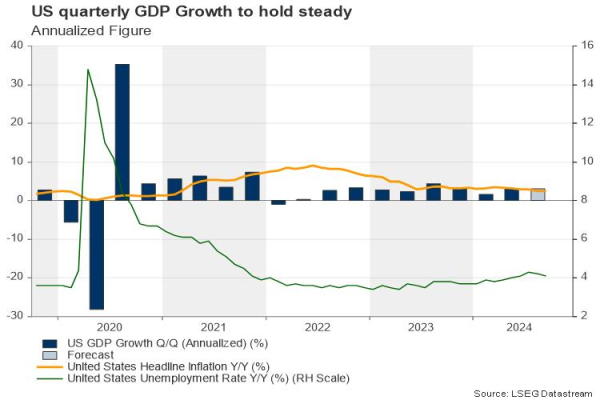

It will be a huge week on the data front, with the core PCE inflation index, the US nonfarm payrolls, preliminary Q3 GDP growth and the ISM manufacturing business PMI index on the agenda. Recent communication from Fed policymakers suggests a gradual approach to rate cuts, which has led to rising Treasury yields - a headwind to high-growth stocks which are traditionally favored in the Nasdaq 100 index.

Futures markets are currently betting on a 25bps rate cut, with another similar expected in December. If the data indicate a resilient US economy once again, scaling back rate cut expectations, Wall Street could pay the price again.

Technical outlook

In technical signals, despite its relatively weaker performance this week, the Nasdaq 100 remains protected above the 20-day simple moving average (SMA) at 20,230, though for the price to climb towards July's all-time high of 20,690 and even try to reach the 21,000 psychological mark, it must first close above the 20,380-20,580 barrier.

On the downside, the 20- and 50-day SMAs might come under examination if the data endorse the case of a second rate cut this year. A step beneath October’s floor of 19,630 could signal a bearish trend reversal.