NASDAQ 100, Dow Jones 30 and S&P 500 Forecast – US Indices Likely to Rally into the Weekend

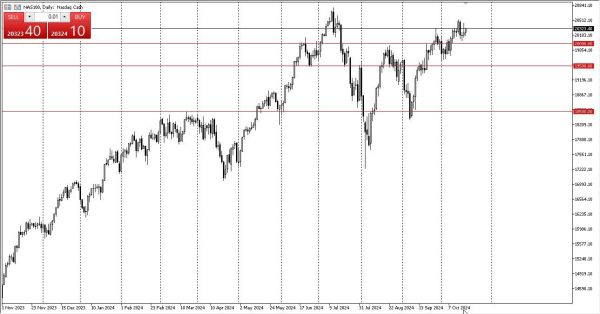

NASDAQ 100 Technical Analysis

The NASDAQ 100 initially did pull back just a bit during the early hours on Friday, but it looks like we are going to continue to see upward momentum and eventually a move to the upside. Given enough time, we will have to deal with the 20,550 level and then eventually the 20,800 level, both of which have shown themselves to be somewhat resistant in the past.

With the economic numbers of the United States coming out relatively stout, and at the same time, it very much looking like the Federal Reserve is going to continue to loosen monetary policy. This has traders on Wall Street willing to take a lot of risk and of course, the NASDAQ 100 is heavily risk laden as these are some of the more innovative companies in America. Short-term pullback should continue to offer plenty of support and buying opportunities.

Dow Jones 30 Technical Analysis

The Dow Jones 30 did initially try to rally, but it gave back a little bit in the early hours. That makes quite a bit of sense because quite frankly, the Dow Jones 30 outperformed the other indices during the previous session. That being said, this is a market that has plenty of support underneath, especially near the 49,900 level. If we break down below there, then the 41,900 level comes into the picture as a potential floor.

If we can break higher, meaning clear the 43,400 level, then the market is likely to continue going to the upside. I do favor the upside in the Dow Jones 30 for the same reasons you would most indices in the United States. It looks like the Federal Reserve is going to step in and try to lift every asset it can as market participants continue to focus on liquidity measures more than anything else.

S&P 500 Technical Analysis

The S&P 500 was a little bit more stagnant. We are still very much in a choppy range bound type of scenario, but it looks like 5,900 is the key here. If we can get above there, then I think the momentum picks up and the S&P 500 probably starts thinking about 6,000, which I figured we would get there by the end of the year. It looks like we might get there sooner.

Pullbacks at this point will still be paying close attention to 5,750 underneath as it’s an area that previously had been resistance and now market memory should dictate that it offers support. Furthermore, we have the 50 day EMA near the crucial 5,675 level and rising. I think that also should offer a bit of a floor. I do believe the S&P 500 will hit 6,000 relatively soon.