NASDAQ Dow Jones SP 500 – US Indices Look to Bounce on Monday

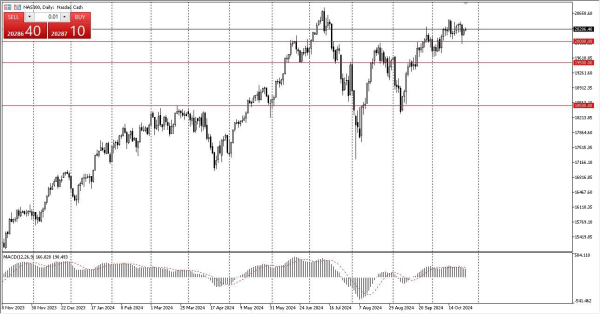

NASDAQ 100 Technical Analysis

The NASDAQ 100 gapped to the upside on Monday and took off to test the top of the shooting star from Friday. At this point, it looks like we are trying to do everything we can to break out. And I do think this market will eventually capture enough momentum that we do take off to the upside and break out to a fresh new high.

After all, it looks like risk appetite is back. Although I’d be the first to tell you things are extraordinarily volatile in other markets beyond the NASDAQ or other stock indices. Short-term pullbacks at this point in time should continue to see support near the 20,000 level.

Dow Jones 30 Technical Analysis

The Dow Jones 30 gapped higher to kick off the trading session on Monday as well, and we are likely to continue to see a lot of support in this general vicinity. Reaching down to the 50-day EMA, the 50 day EMA currently sits at the 41,900 level. And this is an area where the market has seen a lot of support. All things being equal, the market bouncing from here is likely to continue looking to go toward the 43,500 level, which is where we pulled back from previously. The Dow Jones 30 of course will continue to move on liquidity.

S&P 500 Technical Analysis

The S&P 500 gapped higher as well, much like the NASDAQ it is currently threatening to break above a shooting star from Friday. The S&P 500 of course is paying close attention to the Federal Reserve and its liquidity measures, but keep in mind that we are in the midst of earnings season, so all of these indices are paying close attention to that as well.

As things stand right now, it looks like we’re more or less working off some froth from a move higher. Whether or not the US election has any part to play remains to be seen, but most indications that I’ve seen believe that Wall Street is kind of pricing in a Donald Trump victory. There could be a lot of noise on election night, but between now and then, I think it’s more or less steady as she goes.