Netflix beats estimates in 1Q24 and increases its forecasts 📊

Netflix maintains a strong streak and shows strong results for the 1st quarter of 2024. The company managed to surpass both its forecasts and market expectations. The key to success in the first three months of the year lies primarily in the strong growth in the number of new subscribers, which increased by 9.33 million to 269.6 million.

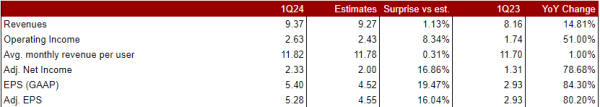

The company recorded revenues of $9.37 billion in the first quarter. This represents a nearly 15% YoY increase and a higher result of +1.13% compared to market expectations. Revenues increased not only due to the growing customer base but also due to the growth in average revenue per membership (ARM). In 1Q24, this value increased by 1% YoY to $11.82. This means a result higher than the expected $11.78. Adjusted for changes in the currency market, ARM would grow +4%, and the difference between these two values results from the weakening of the Argentine peso against the dollar.

The operating profit also looks great, increasing to $2.63 billion (+51% YoY and +8.34% compared to market expectations). This allowed the company to achieve a 28% operating margin (+7 pp YoY). Such an impressive growth resulted from higher-than-expected subscriber growth and the appropriate timing of production spending.

In geographical terms, Netflix recorded revenue growth in the Americas (+7% YoY). In the EMEA (Europe, Middle East, and Africa), revenues remained flat YoY. The most interesting situation ican be observed in South America, where revenues decreased by -4% YoY, but after adjusting for changes in exchange rates, they increased by 16% YoY.

In February and March, streaming began to rebound, reaching 38.5% of the entire US television market, of which Netflix is responsible for 8.1%. According to the management's assessment, the company's still low market share in the television market gives Netflix a large room for further growth, especially thanks to the development in the field of entertainment and cultural events such as sports streaming (including events like Jake Paul vs Mike Tyson fight or WWE).

The company reported EPS $5.28 (+80.2% YoY), which means beating market expectations by 16.04% .

Netflix's financial results for 1Q24. The values (except for earnings per share and average revenue per membership) are given in billions of dollars. Source: Company report, XTB Research.

Netflix's financial results for 1Q24. The values (except for earnings per share and average revenue per membership) are given in billions of dollars. Source: Company report, XTB Research.

Netflix has also raised its revenue growth forecast for 2024. The company expects growth of 13-15%. The projected operating margin has also been increased to 25% (from 24% previously).

The company announced that starting from 1Q25, it will no longer publish data on changes in the number of subscribers. The management explained that they consider their financial data to be more important indicators of the company's condition.

Despite strong results, exceeding expectations, and raised forecasts for future periods, Netflix's stock prices are falling in the after-market hours, with a decline of approximately -3.7%, similar to other companies reporting results during the ongoing earnings season.

Source: xStation

Source: xStation