Netflix: on its way to becoming a trading blockbuster thanks to Swiss DOTS

A year ago, Netflix’s share price plummeted. Now, the streaming giant is enjoying a comeback. Its upcoming quarterly report will reveal whether the company is able to underpin the rally in its share price. Investors are also waiting with bated breath to see whether Netflix uses the opportunity to make a statement on the latest takeover speculations. Swiss DOTS, Switzerland’s leading OTC marketplace for leveraged securities, has the perfect trading instruments to make the most of the reporting date.

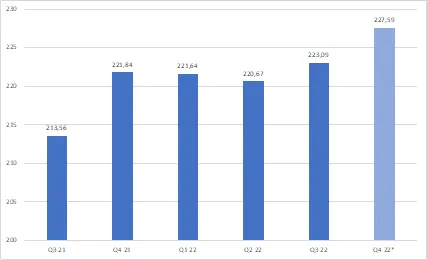

One of the greatest moments in entertainment history is about to celebrate its 10th birthday: Netflix released the first season of House of Cards online on 1 November. This series, following the unscrupulous congressman Francis Underwood on his journey to become to US President, was lauded by audiences around the world. Many say the show, which ran for six seasons, laid the foundations for the global streaming boom — not to mention Netflix’s successful metamorphosis from an online DVD rental service to a global media heavyweight. Now, the California-based company has close to a quarter of a billion subscribers (see graph).

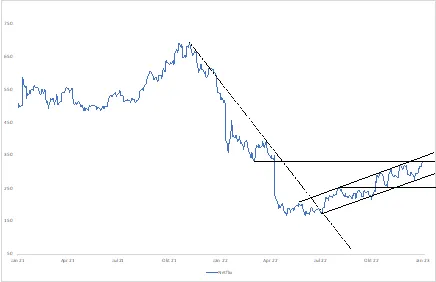

And yet Netflix’s share price took a nosedive last year.

During the first half of 2022, the NASDAQ-traded stock lost almost three-quarters of its value, when the large cap fell victim to the general tech sell-off.

Developments at an operational level didn’t help matters: its subscriber figures fell in both of the first two quarters of 2022. In the autumn, CEO Reed Hastings offered a word of reassurance. “After a challenging first half, we believe we’re on a path to reaccelerate growth,” he wrote in a letter to shareholders. At the same time, the company announced that its user community had grown during the period from July to September 2022. Plus, Netflix was able to regain the trust of Wall Street with an above-forecast increase in revenue and a smaller reduction in its quarterly result than had been feared.

The industry behemoth made it out of the doldrums thanks in no small part to its jam-packed programming. According to information provided by the company itself, Q3 saw Netflix launch some of its most successful series and films to date, such as Monster: The Jeffrey Dahmer Story, the latest season of Stranger Things, and Purple Hearts. In the final quarter of the year, The Crown proved to be a right royal success for the portal. The fifth season of this popular series about the British monarchy hit the headlines even before its release in November, with discussions about its allegedly scandalous content certainly not harming levels of interest in the show. In any case, the CEO expected to see a strong influx of users over the last three months of the year. Specifically, he forecasted 4.5 million new subscribers, almost 90% more than in Q3 2022.

Reed Hastings never tires of emphasising the company’s structural growth opportunities. In this respect, he is fond of mentioning that Netflix makes up just 8% or so of total TV time in the USA and the UK. In addition, the revenue that the group generates across its 190 countries amounts to USD 30 billion, or thereabouts — representing a mere 5% of the total entertainment sector in these markets. Alongside pay TV and streaming (around USD 300 billion), the executive sees brand advertising (USD 180 billion) and expenditure on gaming (USD 130 billion) as potential components of Netflix’s revenue spectrum. “So, we believe that we have a long runway for growth if we can continue to improve our offering steadily over time,” says Hastings.

He makes no secret of the fact that other media and technology firms are looking to take as big a slice of the pie as possible, mentioning that they’re investing billions into new services. “But it’s hard to build a large and profitable streaming business,” explains Netflix’s CEO. In his view, the firm’s competitors are in the red: all told, calculations undertaken by the team in California suggest that rivals must have experienced operating losses of more than USD 10 billion last year. Conversely, Netflix is anticipating an operating profit of between USD 5 billion and USD 6 billion. Hastings states that sector’s focus is increasingly shifting towards sustainable profitability. To this end, prices are being raised or spending on content is cut. “Amidst this formidable, diverse set of competitors, we believe our focus as a pure-play streaming business is an advantage,” writes the CEO.

In its most recent shareholder letter, the company also makes reference to the consolidation of the sector. Reuters caused a stir just before Christmas in this regard, running the headline “Netflix will be next on Microsoft’s shopping list”. Jennifer Saba, the author of the article, lists several reasons why the software titan might be eyeing up the streaming pioneer. In her view, this could mark the continuation of a costly shopping spree on the part of Microsoft CEO Satya Nadella. In fact, Nadella has announced an array of major acquisitions since taking office in 2014 — with the takeover of video game group Activison Blizzard for a hefty USD 69 billion at the top of the list. However, this deal has not yet been signed off by all the relevant authorities.

According to Jennifer Saba, acquiring Netflix would be a smart move, regardless of the success of this mega deal. “‘The two companies are already closely aligned,” she writes. For instance, the streaming service provider has plumped for Microsoft as the advertising partner for its new, advertising-financed service. Plus, the software giant has a senior manager on Netflix’s board, in the form of Brad Smith (Vice Chairman). And that’s to say nothing of the Microsoft Group’s lofty ambitions in the gaming space: the company is already positioned in the market with its Xbox console, and now Microsoft wants to establish a service for streaming video games that can be used on various devices.

Netflix itself is in the midst of integrating video games into its offering. Over the past year, the company acquired the developer Spry Fox, increasing its number of in-house studios to six. “Becoming part of the Microsoft empire would supercharge those ambitions,” states the Reuters columnist. It remains to be seen whether the news agency’s theory is proved correct. In any case, it will certainly be a topic of discussion on the reporting dates for the two companies. Netflix will unveil its report for Q4 2022 on 19 January. This will also reveal whether its recently released shows were a hit and whether the company was able to expand its user community as anticipated.

Netflix has moved into crucial ground on the charts following the turn of the year, with its NASDAQ-traded stock having hit resistance in the USD 330 region. It had tumbled southward from this level in April, opening up a sizeable chasm. If Netflix were able to bridge this gap and make it across to the other side, there’d be nothing stopping it heading towards USD 400. Traders can back an upward rally in various ways, including with a mini-future long (security no. 124203064). At present, UBS has put the stop loss level for this product just shy of 7% under the price of the underlying product. The leverage is similarly generous, at 9.8. The terms for a different UBS mini-future long on Netflix (security no. 123139029) are less aggressive. Here, the stop loss level is a good 18% below the price of the volatile underlying product.

All told, Swiss DOTS is home to more than 900 tradable leveraged products based on the prominent streaming service’s share, with around two-fifths targeted at downward pricing trends. For instance, investors can opt for a mini-future short (security no. 117811210) if they feel that the ongoing rebound isn’t going to be sustainable, or in other words, that Netflix will start heading southwards. While the leverage for this product is 5.8, BNP Paribas has priced in leverage of about half this figure for a different short product (security no. 116610736).

(in EUR)

Swiss DOTS is Switzerland’s leading OTC platform for leveraged products. The Netflix derivatives presented here are among more than 90’000 trading ideas that you can trade on the platform every single day from 8 a.m. to 10 p.m. — for low prices starting from a flat fee of CHF 9/trade.