Netflix Q3 2024 Earnings Preview: What to Expect

When is Netflix's earnings date?

Netflix Inc., the Nasdaq-listed global leader in streaming entertainment, is scheduled to report its third quarter earnings for 2024 (Q3 2024) on Thursday, 17 October 2024. The results will cover the three-month period ending 30 September 2024.

As one of the first major technology companies to report earnings each quarter, Netflix's results are closely watched by investors for insights into consumer spending trends and the health of the streaming industry.

The company typically releases its earnings report after the US market close, followed by a pre-recorded video interview with executives to discuss the results. This format allows for a more in-depth discussion of the company's performance and strategy.

Investors and analysts will be keen to see how Netflix has fared in a competitive streaming landscape, with particular focus on subscriber growth, content spending, and the impact of its crackdown on password sharing.

Netflix Q3 2024 earnings preview: What does 'The Street' expect?

In its previous quarter's results, Netflix provided guidance for Q3 2024, which forms the basis for many analysts' expectations. The company projected:

- Revenue growth of 14% year-over-year, or 19% on an FX-neutral basis

- Lower paid net additions compared to Q3 2023

- Roughly flat global Average Revenue per Membership (ARM) year-over-year due to FX headwinds and plan/country mix

Based on these projections and current market conditions, a consensus of estimates from Refinitiv suggests the following expectations for Netflix's Q3 2024 results:

- Revenue: $9.764 billion

- Net income: $2.234 billion

- Earnings per share (EPS): $5.11

These figures will be closely scrutinised by investors, as they reflect the company's ability to grow its top line while managing costs in an increasingly competitive streaming environment.

Key metrics to watch include:

- Subscriber growth, particularly in international markets

- Content spending and production pipeline

- Impact of password sharing crackdown measures

Analysts will also be looking for commentary on Netflix's strategic initiatives, such as its expansion into gaming and potential live sports offerings.

How to trade Netflix's Q3 2024

Trading Netflix around earnings can be volatile, given the stock's high profile and the market's sensitivity to subscriber numbers.

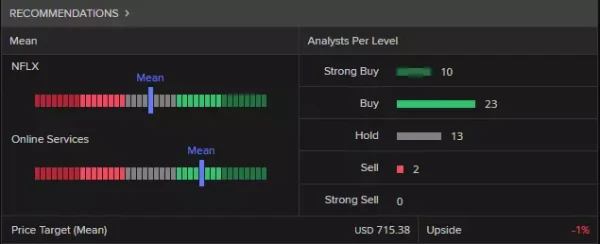

A Refinitiv poll of 48 analysts maintains a long-term average rating of 'buy' for Netflix (as of 14 October 2024). The mean price target of $715.38 suggests that the current share price may be slightly above fair value after a stellar run this year, with the stock up 48.45% year-to-date.

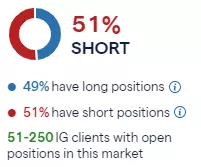

Interestingly, IG client sentiment data shows a nearly even split in expectations:

- 51% of IG clients with open positions on Netflix expect the share price to fall in the near term

- 49% expect the price to rise

This balanced sentiment could indicate uncertainty ahead of the earnings release, potentially setting the stage for increased volatility.

Netflix Q3 2024 results: Technical analysis

From a technical perspective, Netflix's long-term trend remains bullish, but short-term indicators suggest caution may be warranted.

3he stock is currently forming a rising wedge pattern, typically considered a bearish reversal formation when it occurs in an uptrend. This pattern, combined with overbought conditions on momentum indicators, suggests the possibility of a near-term pullback or correction.

Key levels to watch include:

- Resistance: The upper trendline of the rising wedge, currently around $730

- Support: The lower trendline of the wedge, approximately at $690

- Key retracement level: $660.25, which could provide support in case of a deeper pullback

Trend followers might consider waiting for a potential pullback towards the $660.25 level before looking to accumulate shares, aligning with the longer-term uptrend.

However, a decisive break above the rising wedge could invalidate the bearish scenario and potentially lead to further gains.

Factors influencing Netflix's Q3 2024 performance

Several key factors are likely to influence Netflix's Q4 2024 results:

1. Content slate: The strength of Netflix's original content releases during the quarter can significantly impact subscriber growth and engagement.

2. Global expansion: Continued growth in international markets, particularly in Asia-Pacific and Latin America, is crucial for Netflix's long-term success.

3. Ad-supported tier performance: Investors will be keen to see how the lower-priced, ad-supported plan is performing and contributing to revenue growth.

4. Password sharing crackdown: The impact of Netflix's efforts to monetise shared accounts will be closely watched for its effect on subscriber numbers and revenue.

These factors, combined with broader economic conditions and competitive pressures, will play a crucial role in shaping Netflix's Q4 2024 performance and future outlook.