Nike slips 6% amid withdrawing guidance and quarterly revenue miss 📉

Nike (NKE.US) loses almost 7% in today pre-market as investors felt disappointment due to Q1 2024/2025 revenue miss, and withdrawing full year guidance. The company also postponed highly anticipated 'Investor Day' scheduled for November, while gearing up for a new CEO. Because of impending change, Nike decided to withdraw the FY guidance; now wants to provide quarterly guidance 'for the balance of the year'.

- Revenue: $11.59 billion vs $11.65 billion exp, and $12.94 billion a year earlier, down 10% YoY

- Earnings per share: $0.70 vs $0.52 exp. and $0.94 a year earlier) (net result of $1.05 billion vs $1.45 billion a year earlier) down 28% YoY

- Gross margin: 45.4% vs 44.4% exp. by Street Account,1.2% higher than 44.2% in a previous quarter

Nike business is slowing down

Sales across Nike Direct were down 12% YoY, and Nike Digital down almost 20% on a yearly basis. Nike stores sales came in up 1% YoY, but wholesale sales were down 7%, suggesting that further discounts may be needed to sale inventories. The company recorded gross margin expansion of 1.2% to 45.4%, driven by lower costs and pricing actions. Effective tax rate was much higher YoY, at 19.6% vs 12% a year earlier, lifting costs. SG&A came in slightly down, by 2% YoY.

- Very weak results from North America (a major company market) with revenues down 11%, and stores sales down 1% YoY (Nike Direct and Nike Digital down 11% and 15% respectively). Also, EMEA sales came in down 12% YoY, while Greater China revenue slipped 3% YoY (Nike Direct down 16% and Nike Digital down 34% YoY). APLA revenue was quite strong compared to other markets, with 'only' 2% down YoY and 9% higher sales in NIKE stores. Nike, informed about weak sales in the Jordan brand, now expects continued declines in its men's and women's lifestyle business.

- Nike expects 8 to 10% revenue in Q2 2025, with margin down approximately 1.5% and SG&A flat YoY; high-teens effective tax rate. The company informed about 'double-digit' growth in new footwear products sales (global football, running footwear); strong growth in Pegasus 41 model (mid-teens growth YoY), declared strong orders for spring '25. However, Greater China demand is still sluggish, with slowdown across the US market and retail sales underperformed expectations (inventories issue, pressure on discounts).

Nike (D1 interval)

Nike stock reacted with (today) decline after reaching EMA200 (red line) resistance. Current pre-market quotations suggest opening at $83 per share, still almost 20% higher than multi-year lows at $70 level.

Source: xStation5

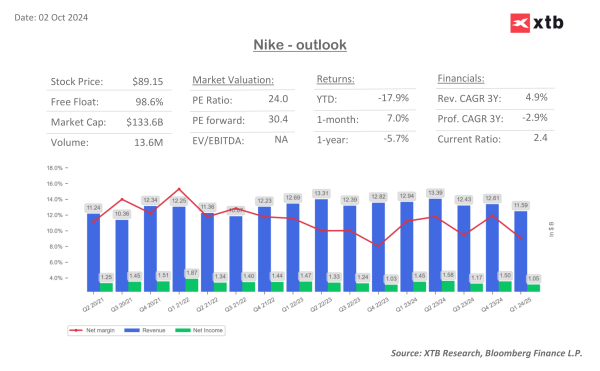

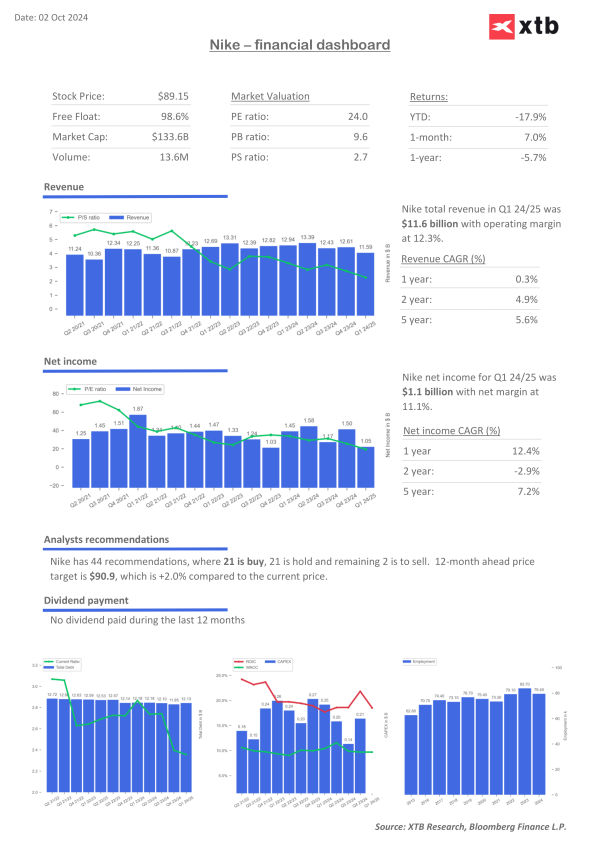

Nike financial dashboards

Given the company business slowdown (falling sales, mixed net earnings, pressured margins and further macro-related uncertainty), given multiples with PE forward above 30 and current PE ratio almost 10% higher than S&P 500 average, we can cautiously assume, that company valuation seems to be stretched.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Reserach, Bloomberg Finance L.P.