Nvidia drops 3% ahead of earnings release 📉

Nvidia (NVDA.US) will release its Q4 2024 financial report today after the close of trading on Wall Street. The report for the calendar period from November 2023 to January 2024 will be released around 09:20pm GMT and will show whether the company's results are in line with the AI trend that has pushed the company's shares to record levels. The company is having a weak session today, with its shares losing more than 3%.

Today's declines are largely due to a change in investor positioning in the options market. An increase in the involvement of market sellers (for speculative/hedging purposes) has pushed the put/call ratio down to 0.64. However, it is worth mentioning that back at the beginning of February, this option positioning indicated a ratio of 0.57.

- Nvidia (NVDA.US) Put/Call: 309.43K/4482.52K Net Option Delta Today = -619.50K shares

- Rivian (RIVN.US) Put/Call: 66.16K/104.91K Net Option Delta Today = 153.07K shares

- Lucid (LCID.US) Put/Call: 36.99K/49.12K Net Option Delta Today = -176.77K shares

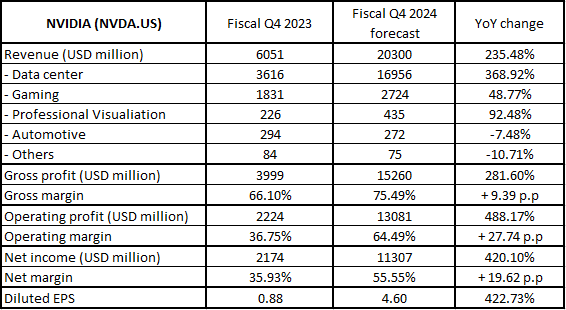

Expectations for Nvidia's fiscal Q4 financial results. Source: Bloomberg Finance LP, XTB Research

Beating them and raising annual forecasts may be necessary to maintain bullish momentum in the broad market. Implied volatility indicates a resultant variance of +/- 10%, or a change in the company's capitalisation of around $166bn.

Source: xStation

Source: xStation