Nvidia Earnings Recap: A Beat, But Not A Big Enough Beat

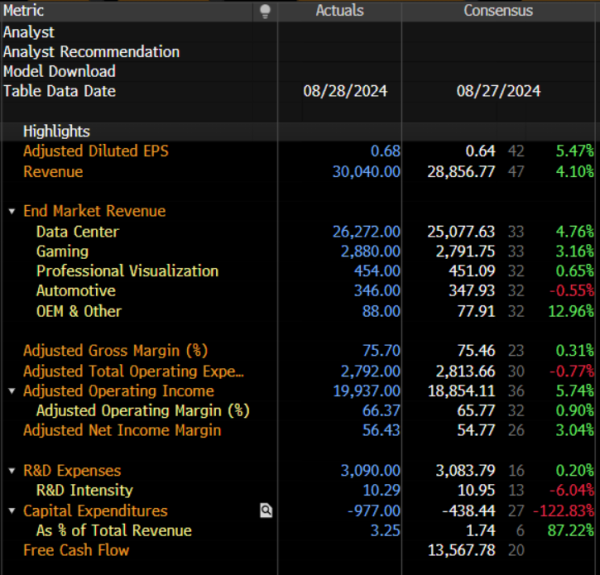

The tech behemoth, and linchpin of the AI theme that has dominated markets to such a significant degree over the last year or so, duly delivered both top- and bottom-line beats in its quarterly earnings report, with quarterly EPS at $0.68 on revenues of $30.0bln. The quarterly EPS beat marks the 7th straight quarter in which NVDA have beaten consensus earnings expectations.

Preview

PreviewIn terms of individual revenue lines, the key data centre revenue figure beat market expectations at $26.3bln, while margins were also 0.2pp wider than expected at 75.7%. It was also noteworthy that NVDA flagged shipments of the flagship ‘Blackwell’ platform will begin to ship in fourth quarter, delivering “several billion dollars” of revenue, at the same time as production ramps up.

Of course, it was not only the figures themselves of interest to market participants, but the guidance accompanying said figures, as investors gauge whether the recent run of strong performance can continue into the future.

Given the monopoly-like status of Nvidia within the AI/chipmaking sector, at least for the time being, it was perhaps unsurprising to see strong forward guidance issued. Guidance from the chipmaker was solid, with fiscal Q3 revenue seen at $32.5bln, just a touch above the $31.9bln sell-side consensus.

In reaction to the earnings, and guidance, beat, Nvidia stock was incredibly choppy, though ultimately the bears ended up prevailing, likely as a result of the narrower-than-expected guidance beat. The stock traded as much as 7% lower in after hours trade, though such a decline was pared as the post-market session progressed, and was also well within the slightly ridiculous +/- 9.8% implied move that derivatives contracts had priced. Other chipmakers also saw some weakness, with Arm Holdings and AMD also softening in the post-market session.

At a broader level, NVDA’s earnings caused a significant reaction, as expected given that the stock is the second largest constituent of both the S&P 500, and the tech-heavy Nasdaq 100.

Front futures for each printed fresh session lows as NVDA slid after hours, with the Nasdaq extending earlier losses to as much as 2%, before paring losses in line with the modest recovery seen in NVDA stock.

Looking ahead, with Nvidia earnings out of the way, the next significant event risk for equities to navigate doesn’t come until 6th September, in the form of the August US labour market report, though Friday’s PCE figures do have the potential to cause some short-term intraday vol.

Until the NFP print, equities could well be in for something of a choppy spell, as risks around the AI theme become increasingly two-sided, and a lack of external catalysts present themselves. Nevertheless, over the medium-term, , the path of least resistance likely continues to lead to the upside for equities, with economic, and broader earnings growth, both still strong, at the same time as the ‘Fed put’ continues to backstop sentiment, providing participants with confidence to remain further out the risk curve, and keeping dips relatively shallow in nature.