Nvidia loses 6% despite strong Q2 earnings 📉 Wall Street disappointed with report from AI giant? 📊

Nvidia (NVDA.US) shares traded 7% lower after the release of its Q2 2024 (Q2 fiscal 2025) results, giving back nearly 200 billion in capitalization. Revenues came in slightly lower than 'unofficial' expectations; markets would likely have been satisfied with a result well above $30 billion in Q2. The company also reported a decline in gross margin, and revenue forecasts for Q3 2024 slightly beat expectations. It's also worth noting that the company has rebounded by roughly 30% in the last less than 3 weeks, adding $700 billion into the market cap since August 7, which probably 'encouraged' some investors to 'sell the news' after a successful quarterly results. Here's how the company's performance fared in numbers, against consensus.

Nvidia report (fiscal Q2 2025)

- Revenue: $30.04 billion, up 15% from the previous quarter and up 122% from a year ago. Analysts expected $28.85 billion forecast (company indicated $28.56 billion) vs. $26.04 billion in Q1 2024 and $13.51 billion in Q2 2023.

- Earnings per share (GAAP EPS): $0.67, up 12% from the previous quarter and up 168% from a year ago. Analysts had expected $0.64

- Net income: $16.6 billion, up 12% from the previous quarter. Up 168% year-on-year.

- Gross margin: 75.1% in line with expectations (-3pp quarter-on-quarter, Q1 was almost 79%), and operating margin 62% (also down -3pp quarter-on-quarter).

Nvidia approved a new $50 billion share buyback and a dividend of $0.01 per share (payable October 3, with a dividend date of September 12)

- Data centers: $26.3 billion, up 16% k/k and 154% y/y

- Gaming: $2.9 billion, up 9% k/k and 16% y/y

- Professional visualization: $454 million, up 6% k/k and 20% y/y

- Automotive: $346 million, up 5% k/k and 37% y/y

- Other: about $100 million (13% increase q/q)

Nvidia expects $32.5 billion in Q3 2023 (possible 2% deviation); analysts had predicted $31.9 billion on average, and estimates have even said $37.9 billion. It also expects gross margins between 74.4 and 75% - so here without the expected improvement and steadily high. Operating expenses are expected to rise to $4.3 billion (GAAP). The initial reaction to the results was mixed, followed by more downward movement. The final market reaction will likely have to wait, until the US market opens tomorrow. Investors, however, did not 'buy' the report as justifying the company's high valuations and expectations.

Technological innovations progress

The company indicated that it has already built a number of Blackwell GPU AI systems, next-generation - equipped with NVIDIA Grace processors, networking solutions and infrastructure from renowned manufacturers including GIGABYTE, QCT and Wiwynn.

- The company also sees adoption of the Nvidia SpectrumX Ethernet network business among cloud businesses, GPUs and business partners. About 150 companies are expected to use the network for Nvidia NIM developers. According to Nvidia,

- Japan has bolstered its AI capabilities with the ABCI 3.0 supercomputer, based on Nvidia's IQuantum-2 InifityBand and H200; it is also seeing increased work on quantum supercomputing in many countries. The company also expanded GeForce NOW for gamers in Japan and conveyed that it now supports more than 2,000 titles and is planning new ones.

- Nvidia is also working on bringing 'digital' human characters, into the gaming world and implementing 'AI agents' into the gaming world - which sounds a bit like SciFi.

- Taiwanese electronics makers are creating autonomous factories through a new reference workflow that combines NVIDIA Metropolis vision AI, NVIDIA Omniverse simulation and NVIDIA Isaac AI robot development.

What does the company see?

Comments from CEO, Jensen Huang suggest that demand for AI Hopper chips remains huge, while expectations for Blackwell chips are huge (the company expects them to be 30x more efficient and 25x more energy efficient). Overall and in the company's comments, there is nothing to suggest a slowdown - but it is seen more in the numbers and the bigger picture (which is not a big surprise, as the company exceeded $3 trillion market cap). Revenue growth of $2 billion quarter-on-quarter, with a capitalization of $3 trillion and a price-to-sales ratio near 40, does not seem dizzying.

- Gross margins are also stabilizing at slightly lower levels than in the first quarter of the year. The main risks remain the macroeconomic situation, in the face of which orders for AI products may slow down, and the slowly emerging competition.

- On the other hand, the visionary technologies being introduced (Blakcwell GPU, network business, gaming, quantum computing, etc.), the wide business moat and the quality of Nvidia's management seem quite resistant to any attempt to take its market share, the scale of which is invariably supported by Nvidia CUDA.

Nvidia's current valuation represents about 12% of U.S. GDP, and the 150% rally in its stock price has contributed 18% to this year's 19% rise in the overall S&P 500 index. The reaction may indicate that with the continued risk of slowing economies across the globe, investors will be looking more closely at fundamentals. However, Wall Street will need to wait until tomorrow's session for a final reaction.

Nvidia stock chart (D1 interval)

Nvidia shares are pointing to an opening near $119 per share, where we see the 23.6 Fibonacci abolition of the upward wave from the fall of 2022, when ChatGPT was first unveiled. A drop below this level (and the 50-session average) could herald a retest of the early August 2024 lows (around $90-$105). The main support zone runs at around $90 per share (simple 200-session moving average). Resistance is determined by the vicinity of $130 per share.

Source: xStation5

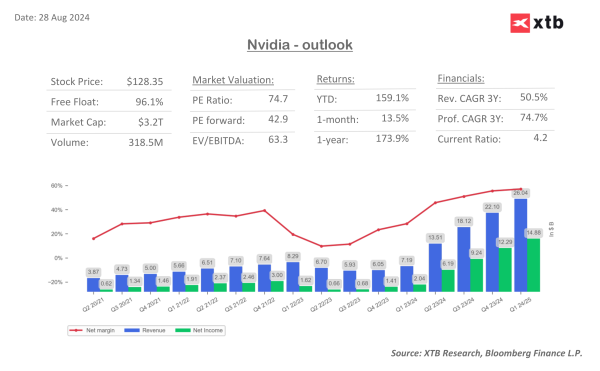

Nvidia business valuation - Wall Street consensus (before the session on August 28, 2024).

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.