Nvidia (NVDA) confronts high expectations for Q4 results

Nvidia is arguably the hottest company on the planet. The company reports its Q4 results after the closing bell on Wednesday, the 21st of February. We preview what to expect from Nvidia’s earnings and analyse the technicals of its stock price.

Analysts expect Nvidia to quadruple EPS in Q4

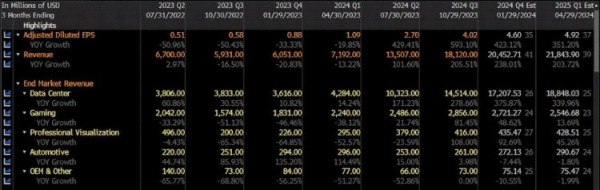

According to data derived from Bloomberg (pictured below), analysts are expecting a very strong performance by Nvidia in Q4. Revenues are forecast to more than double from a year earlier to $US20.45B, underpinning a projected quadrupling in earnings to $4.60.

The performance is expected to be driven by booming demand for microchips due to the extraordinary growth in generative AI. In particular, Nvidia’s growth is expected to come from its data-centre segment, which analysts expect to grow by 375% to make up more than 80% of the company's topline.

Source: Bloomberg

Source: Bloomberg (Past performance is not a reliable indicator of future results)

The strong financial performance is forecast to carry on into the 2024 fiscal year, and in Q1. Analysts project another 351% increase in earnings next quarter, off the back of another significant lift in sales.

Several risks could unsettle investors and present a potential downside for the company’s earnings. The issue of double ordering persists amidst a rush to secure chips, although that risk is arguably lower than the previous quarter as supply and demand normalise. There is also the issue of geopolitical tensions and trade restrictions after the US banned the sale of certain chips to China. Disappointing guidance regarding sales in China sent Nvidia’s share price lower after last quarter’s results. Investors will be looking for signs of progress in the production and sales of China-compliant chips.

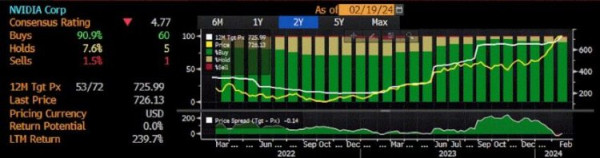

Despite arguably rich valuations, with Nvidia's price-to-sales alone an eye-watering 40/1, analysts remain optimistic about the company’s stock. According to Bloomberg data, it boasts a consensus buy rating amongst 66 analysts, with 60 making that recommendation. The consensus price target is almost precisely the current market price, suggesting the stock may be at fair value.

Source: Bloomberg

Source: Bloomberg (Past performance is not a reliable indicator of future results)

What is your sentiment on NVDA?

902.05 Bullish or Bearish Vote to see Traders sentiment!Market sentiment:

Bullish Bearish

88% 12%

You voted bullish.

You voted bearish.

Give NVDA a try

Start trading Start trading Start trading or Try demoTechnical analysis: Nvidia shares hover near record highs

Nvidia shares remain in an uptrend and a fraction below all-time highs. In the very short-term, sellers have emerged above $US740 per share, with a break and hold above that level a bullish signal the stock’s uptrend can continue. The daily RSI is signaling overbought conditions and a possible reversal in momentum unfolding. A confluence of levels exists around $US700, including tentative trendline support, which, if broken, could spark a deeper pullback.

Source: Capital.com

Source: Capital.com (Past performance is not a reliable indicator of future results)