Nvidia Q2 earnings report will be released today💲What does Wall Street expect?🔎

The main driver of the global tech bull market, Nvidia (NVDA.US) will release its financial results for Q2 2024 (fiscal Q2 2025) after the US session today. The market expects revenue growth of more than 110% YoY, and hopes that the stock will give even more fuel to the growth of global indices and technology company valuations, laying yet another solid argument for an 'AI-driven bull market'.

The second quarter of the year for BigTech companies did not bring a 'wow effect', although their business remained at excellent, virtually record levels in history; most raised CAPEX for infrastructure. However, the high expectations and great quarters that highly valued Nvidia has behind it may face obstacles, and at current valuation levels and levels of optimism, it seems that even a small 'crack' in the report could put the company's shares under considerable pressure. Here are the investors expectations:

Nvidia Q2 Wall Street expectations:

- Revenue: $28.85 billion (112% y/y growth, above the upper range of the company's expectations, which pointed to $28.56 billion), $26.04 billion in Q1 2024 and $13.51 billion in Q2 2023

- Adjusted earnings per share (EPS): $0.64 (lower range $0.55, upper range $0.77)

- Data centre revenue: $25.07 billion, 141% y/y growth vs. $22.06 billion in Q1 2024

- Net income: $14.95 billion, 139% y/y growth vs. $14.88 billion in Q1 2024 and $6.19 billion in Q2 2023

- Gross margin: 75.4%, 70% y/y growth (middle range of NVDA guidance; company expected between 75% and 76% in Q2)

Realistically, Wall Street hopes, of course, for a clear beating of the above expectations; Nvidia's revenue should probably turn out to be higher than $30 billion to encourage investors to continue buying and discourage selling. A report virtually in line with forecasts, markets may take as a signal that Nvidia's 'astronomical' growth is starting to slow down, which perhaps calls for 'repricing' on the side of multipliers and a clear premium in valuation. The question is how much the company 'squeezed' out of a solid Q2 year for Big Tech, and whether companies will be willing to spend more and more on AI when some economic uncertainty persists ahead of Fed rate cuts, in the fall. Will this also encourage Nvidia to issue a 'more cautious' forecast?

What will Wall Street pay attention to?

Nvidia reported production problems with Blackwell chips (new generation, according to the company, about 25x more energy efficient than Hopper and 30 times more powerful), but calmed the mood that production at TSMC (TSM.US) will finally start in the second half of this year, and the delay will not be significant.

-

However, the postponement of chip sales to Q1 or H1 2025 could be received nervously, although according to Raymond James analysts, paradoxically, it could further increase interest in their offerings (the prospect of limited supply)

- Wall Street remains quiet on the pace of AI hardware infrastructure spending. Alphabet, Microsoft, Amazon and Meta Platforms are expected to spend a combined total of about $200 billion on AI-related technology investments this year.

- According to some sources (including Vanguard), however, estimates of growing demand for AI may be exaggerated. It seems that the key will be on the side of the real health of the economy and the appetite of Nvidia's customers, than from the company itself. Second-quarter data from the U.S. economy (and the earnings season) were quite solid, and it does not appear that the company's business will see a slowdown during this period

Much will therefore come down to the company's own expectations, which will allow traders to estimate to what extent the mixed macro uncertainty could (and if at all) hit expected demand for its data center, cloud infrastructure and AI software solutions. Currently, Nvidia holds about 95% market share in the global distribution of AI chips, and the scale of customer interest means that 'joining' the market with the likes of AMD and Co. is not a significant risk to the company's business,

NVDA.US chart (M30 interval)

Nvidia shares rose 1.8% yesterday and are gaining slightly today in pre-opening trade, adding 0.16%. The company is still trading close to 8% below historical highs. The stock has managed to break the 71.6 Fibonacci retracement of the June 2024 decline at $126 per share and is near a 30% retracement of the August 5-7 declines, since which the company's capitalization has risen by about $750 billion. The options market implied about 9.8% volatility after the Q2 earnings report; previously the market had expected lower volatility. Importantly, the stock managed to rebound 30% from its August low, which may indicate that the report must be great to push the stock even higher. On a year to date basis, Nvidia 150% stock market rally contributed 18% to overall S&P 500 performance.

Source: xStation5

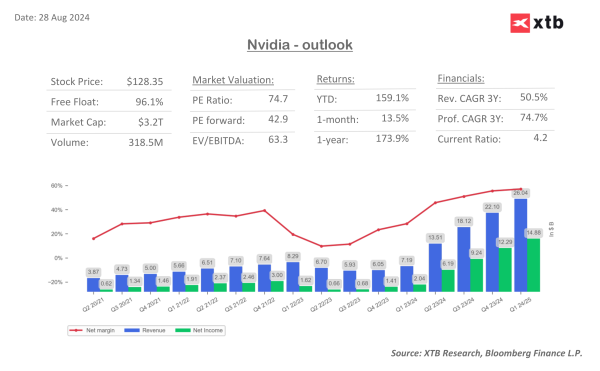

Nvidia business dashboards - Wall Street consensus

The company's revenue has grown by about $4 billion every quarter in recent quarters. Maintaining this momentum now would suggest revenues minimally above $30 billion. Valuation on the price/sales and price/earnings ratios side remains very challenging, with 64 price to book ratio.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.