Nvidia: Strong growth outlook due to megatrends

Driven by megatrends such as gaming and artificial intelligence, US chip designer Nvidia could resume its growth trajectory again during the current year. With selected leveraged securities on SwissDOTS substantial returns can be achieved.

These are hard times for the chip industry. Over the past year the Philadelphia SE Semiconductor Index has plummeted by a full 36%. Recent announcements have added to the sector’s woes: Samsung Electronics, for example, posted its lowest quarterly profit since 2014 and predicts a difficult first half of the year, while industry giant Intel actually expects a loss for the current quarter.

However, investors should not lump all semiconductor manufacturers together; a crucial factor is how individual companies are positioned. For example, a welcome surprise came from Mobileye, a provider of driver assist systems. Nvidia, too, operates in many areas tapping into future trends and so is well-placed to achieve its targets. In the third quarter the chip designer was even able to exceed its sales forecasts by just under 3%, reporting revenue of USD 5.93 billion. For the final quarter of the 2022/23 financial year (29.01), Nvidia forecasts revenue of USD 6 billion; its results will be reported on 22 February.

As far as growth is concerned, during the past financial year Nvidia has taken a break. This applies not just to revenue but also to profits. Analyst consensus is that earnings per share will have reduced by 15.2% to USD 3.26. However, such a decline does not come as a surprise; Nvidia already issued a hefty profit warning in the summer of last year, warning investors of a lean spell in light of macroeconomic headwinds. This was not without consequences for the share price: the Nasdaq-100 security lost half of its value in 2022.

Investors know that on stock exchanges it is the future that is traded — and for the semiconductor industry, the future is not looking bad at all.

Analysts at Daiwa Capital Markets expect demand in the storage market to pick up in the second half of this year, supported by the launch of new products and the recovery of demand in China due to its reopening. Brokerage firm Piper Sandler takes the same line, anticipating not only that the market for mobile phones and PCs will have largely bottomed out by the end of the first quarter but also that the video gaming segment is already on the verge of an upturn. This is an important point for Nvidia, as the company earns more than a quarter of its revenues in this sector.

After seeing its gaming segment’s revenues halve in the third quarter, Nvidia is counting on new products such as the high-end “GeForce RTX 4090” to get the segment back on a growth course. Nvidia is also investing heavily in its gaming library: the total number of games available on its cloud gaming platform “GeForce Now” has increased to over 1’400. In addition it has launched its “DLSS 3” performance multiplier, which with the help of artificial intelligence (AI) can create higher-definition images in games such as Microsoft Flight Simulator.

Apropos AI: at the moment, everyone is talking about Nvidia’s GPUs, especially due to the hype around “Chat GPT”. This new programme from OpenAI, which apparently gives a relevant answer to every question, is being trained with the help of Nvidia processors. This again illustrates how strongly positioned the company already is in the field of artificial intelligence. This is also the case for “autonomous driving”. In this segment revenues increased by 86% to USD 251 million in the third quarter. This was helped, among other things, by the market launch of the Polestar 3, which is fully electric and the first SUV to run on the Nvidia DRIVE platform.

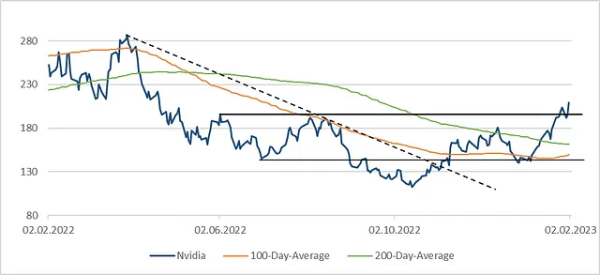

Analysts expect Nvidia to shortly return to its growth trajectory. In the coming two years earnings per share is predicted on average to rise by 30 per cent. With a 2024 P/E ratio of 34, the high-margin US chip manufacturer is thus not overvalued. It is therefore no surprise that the share’s consensus rating is “Buy”. The share also gets a green light from a technical analysis perspective: in the most recent share price upswing, both the 100-day and 200-day moving averages were exceeded. Currently the tech stock is struggling to break outside of the horizontal resistance level of USD 200. If it manages to do so, this would pave the way for it to reach the USD 220/230 range. Impetus for this could come from the forthcoming results. However, a note of caution: if Nvidia’s results disappoint, there is a risk it will drop back to around USD 160/170.

Investors with a short-term positive outlook may select the SwissDOTS-listed call warrant (ISIN CH1209450290) issued by BNP Paribas. At USD 200, the strike is just above the current share price level. If the “bullish bet” on the results announcement proves successful, this note should rapidly be “in the money”. Price movements are multiplied by a leverage of 7.56. Please note: this product is designed for a short-term trade only, with the term already ending on 17 March 2023. On the other hand, the mini future long (ISIN CH1244023128) from UBS is an appropriate product if you are betting on a medium-term upturn in the share price. The open-ended security has leverage of 5.44 and a spread of under 1%. The Stop Loss is USD 164.53058 and therefore almost 16% below the current price of the underlying.

In the event that Nvidia disappoints, with the knock-out warrants (ISIN: CH1237833293) from UBS it is possible to switch to the short side quickly and effectively. Towards the next technical support range of USD 160/170, the leverage of 7 would then ensure disproportionate gains.

Swiss DOTS is Switzerland’s leading OTC platform for leveraged products. The Netflix derivatives presented here are among more than 90’000 trading ideas that you can trade on the platform every single day from 8 a.m. to 10 p.m. — for low prices starting from a flat fee of CHF 9/trade.