NZD: Rate Cut Cycle Has Kicked Off

Key points:

- The Reserve Bank of New Zealand (RBNZ) has started an easing cycle by cutting the Official Cash Rate (OCR) by 25 basis points to 5.25%, a move that was not anticipated by the consensus. This decision was made to avoid falling behind the curve amid deteriorating economic conditions.

- New Zealand's economy is facing broad-based weaknesses, including slowing immigration, rising unemployment, and tight fiscal policies. Inflation has softened to 3.3% YoY in Q2, down from 4.0% in Q1, providing room for the RBNZ to cut rates. The economy is contracting faster than anticipated, with the central bank forecasting a recession in Q2 and Q3.

- The dovish rate cut has put downward pressure on the NZD, exacerbated by Governor Orr's comments about the economy facing its 'darkest period'. However, the market has already priced in significant rate cuts, limiting further downside unless the RBNZ surprises with more aggressive cuts or economic data worsens sharply.

The Reserve Bank of New Zealand (RBNZ) has initiated an easing cycle, cutting the Official Cash Rate (OCR) by 25 basis points to 5.25%. While this move was not anticipated by the consensus, we argued that any delay in starting the easing cycle could risk the RBNZ falling behind the curve.

Grim Economic Outlook

Economic conditions in New Zealand are deteriorating, with broadening weakness across sectors. Softening inflation, along with cracks in the economy, gave room to the RBNZ to initiate its rate cut cycle. Inflation fell to 3.3% YoY in Q2, down from 4.0% in Q1. Meanwhile, the latest data highlights several concerning trends on the growth side:

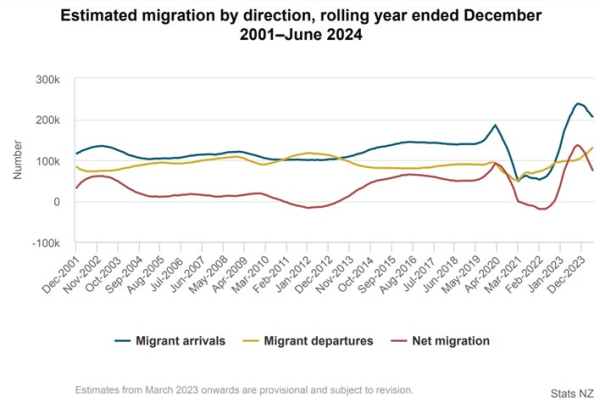

- Immigration and Population Growth: Net immigration flows into New Zealand have slowed significantly, falling to their weakest in 16 months in June, contributing to weaker population growth. This slowdown has implications for consumer demand and the broader economy, which is already struggling with weak retail sales and business sentiment. The reduction in migration has also led to less pressure on housing, contributing to a cooling property market.

- Labor Market Dynamics: The labor market in New Zealand is showing signs of stress. In Q2 2024, the unemployment rate rose to 4.6%, the highest in over three years, up from 4.4% in the previous quarter. Although employment increased by 0.4% quarter-on-quarter, the rise in unemployment was driven by a higher participation rate. Average hourly earnings growth slowed to 4.0% year-on-year, down from 4.8% in Q1 2024. This suggests that wage pressures are easing, and inflation could return to the RBNZ’s 1-3% target range in the coming quarters. Meanwhile, the labor market remains fragile, with the risk of further weakening as the economy slows.

- Tight Fiscal Policy: NZ’s budget deficit is widening and that could put pressure on the current coalition government to implement spending cuts and tax measures that could further constrain economic activity. This fiscal austerity, while aimed at maintaining long-term fiscal stability, could exacerbate the slowdown by reducing public investment and limiting consumer spending.

These trends suggest that the economy is on the brink of a recession, and the RBNZ statement noted that the economy was contracting faster than anticipated, and showed a recession in Q2 and Q3.

NZD Could See Immediate Downside but Key Reversal Triggers Ahead

A dovish rate cut from the RBNZ has weighed on the kiwi dollar, especially given that the move was not fully priced in by the markets. Governor Orr’s comments that the economy is now facing its ‘darkest period’ and that a 50bps cut was considered has lent further downside pressures to the NZD. It was perhaps the Fed’s hold that likely pushed the RBNZ to adopt a slightly more conservative stance with the easing cycle for now.

However, two key catalysts remain on watch for any reversal in NZD's decline:

- Rate Cut Cycle Already Fully Priced In: The market has already priced in more than one full rate cut by the RBNZ at its upcoming October meeting, and end-2024 OCR is seen at 4.5% compared to RBNZ’s forecast of 4.92%. Market also expects a cumulative 160 basis points (bps) of rate cuts by mid-2025, compared to the RBNZ's latest projection of 101 bps in cuts over the same period. With the market already positioned for a dovish trajectory, there is limited room for further downside unless the RBNZ surprises with even more aggressive cuts or the economic data deteriorates sharply. Conversely, if the RBNZ's actions or economic data suggest that the market has overestimated the easing cycle, the NZD could experience a sharp rebound, especially against other currencies where the easing cycle may be underpriced, such as the Australian dollar (AUD). For comparison, the RBNZ didn’t see a rate cut

- Global Recession Fears: The NZD, like other commodity and activity currencies, is particularly sensitive to global economic conditions. The increasing concerns about a global recession, particularly if the US economy falters, could weigh on the NZD. A global downturn would likely lead to reduced demand for New Zealand's exports, weakening the currency. However, if the global economic outlook stabilizes or improves, and the US soft-landing remains achievable, the NZD could see a resurgence as risk sentiment recovers.

In summary, while the immediate outlook for the NZD appears bearish, these two factors—global recession fears and the market’s potentially over-extended pricing of the rate cut cycle—could act as significant reversal triggers for the currency. From a technical perspective, NZDUSD is locked in a consolidation and breakout may be needed for a clearer direction. A sustained move above the 200-day SMA (0.6088) could signal a bullish trend.

Disclaimer:

Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved.

FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money.

Recent FX articles and podcasts:

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

Recent Macro articles and podcasts:

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar