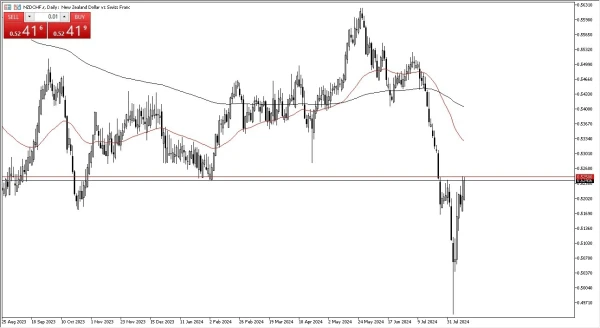

NZD/CHF Forecast: Pressuring Major Level

- The pair is one that I'm very interested in paying attention to, due to the fact that we have seen the market bounce into the 0.5250 level, an area that has been important multiple times.

- All things being equal, this is an area that there should be a certain amount of market memory attached to it, but what I think is going to be more important is the central bank of New Zealand and whether or not they are going to cut rates.

Currently, the market is not looking for a rate cut, but things have been shaky enough recently that we have seen a couple of surprise cuts here and there around the world. So that is a situation that we have to be prepared for. If the central bank of New Zealand does in fact cut rates, we could drop all the way back down to the 0.50 level. This of course is a large, round, psychologically significant figure, and therefore people will be very interested in it as per usual.

Top Forex Brokers

1Risk Appetite

On the other hand, if we do not see a rate cut and we see more of a risk on type of attitude around the world, the New Zealand dollar could spike, perhaps looking to the 0.5333 level where the 50 day EMA currently resides, or perhaps even higher than that, closer to the 0.54 level near the 200 day EMA.

In general, we are at a major point of inflection that we need to pay close attention to, and I do expect to see a significant reaction one way or the other. I suspect that the next 50 pips will probably end up determining the next 200, so this is a chart that has definitely caught my attention. Keep in mind that risk appetite will have its part to play. Money will leave New Zealand and head to places like Switzerland for safety, and of course, vice versa. Recently we've seen China do a couple small cuts, so that tells you that Asia may be teetering a bit, which could work against New Zealand.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.