🛢️Oil gains over 2%

Fears about Israel's attack on Iran

Oil started today's session very calmly, but early in the afternoon, oil returned to gains, continuing the strong movements from last week. During the weekend, there was no retaliatory attack by Israel on Iran, which may be related to Biden's statement last Friday. He indicated that he doesn't know when an attack will occur, but emphasized that there are other alternative responses than attacking oil-related infrastructure. It's worth noting that the rise in oil prices is undesirable at this moment for the Democratic camp, who want to show that they have control over maintaining low prices at gas stations.

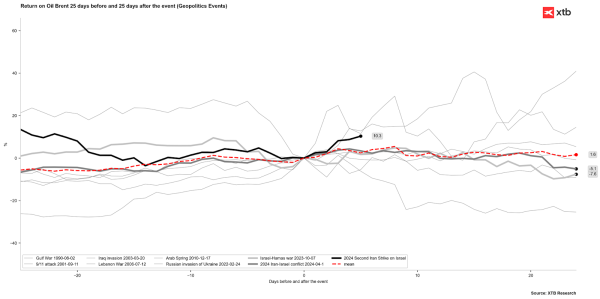

Brent crude has already gained over 10% since the start of the next chapter in the conflict between Israel and Iran. It was initiated by Israel's entry into Lebanese territory, which was met with Iran's response in the form of a missile attack on Israel.

Brent crude is already gaining over 10%, and this is one of the largest increases, considering other geopolitical situations in the Middle East. Source: Bloomberg Finance LP, XTB

It's worth mentioning that Libya has currently restored production above 1 million barrels per day, and Iran has resumed production in many places after previously halting it due to attack concerns. Goldman Sachs indicates that if a series of responses begins on both sides of the conflict, Brent crude could return above $90 per barrel. The $100 scenario would require a permanent shutdown of part of Iran's production. Iran currently produces 3.3 million barrels per day and exports 1.7 million barrels per day.

A look at the Brent crude price

Brent crude reached $80 per barrel today. This level is close to the 50.0 retracement of the entire downward wave that started from this year's peak in April at $92 per barrel. Oil is also retreating after reaching the 100-session average. It's worth noting that the current rebound coincides with the previous large correction from June in the current downtrend. However, if there's a breakthrough around $80.0 along with the 50.0 retracement, then buyers' targets could be around $83, and then the zones at $87-88 per barrel.

Source: xStation5