Oil: Supply Jitters Push Prices Close to a 5-Month High

As investors focus on Middle East tensions, Oil (CL) prices increase and are trading close to a 5-month high at $86.78 at the time of writing on April 9th, 2024. Let’s take a closer look at the reasons that are pushing prices higher and why it could become an issue for central banks.

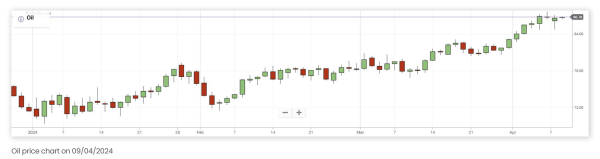

Oil Price Snapshot of 2024: April 9th, 2024

Oil has been in a bullish market since the beginning of 2024. The energy commodity started the year at about $71.74 and is trading at $86.78 at the time of writing (April 9th, 2024).

Tensions in the Middle East Intensified Worries About Oil Supply

Imagine a vast network of pipelines and tankers constantly carrying oil from producer regions to the rest of the world. When political tensions erupt in these regions, particularly the Middle East, it disrupts this system. War, military actions, or even the mere threat of such can have a cascading effect on the oil market, and the overall financial markets by extension.

Firstly, key infrastructures such as pipelines become vulnerable to attacks or sabotage, directly restricting oil flow. Secondly, shipping companies become wary of operating in the concerned regions, reducing the number of containers willing to transport oil. This creates a bottleneck, limiting the amount of oil reaching its destination. Finally, strategic waterways crucial for oil transportation might be closed due to military activity or security concerns, which also hinder the flow of oil.

The consequence of these disruptions hinges on a fundamental economic principle: supply and demand (a key driver of commodity prices).

When less oil is readily available, then it creates a scenario where demand for the same amount of oil outpaces the limited supply. As a result, the price inevitably rises – a classic case of scarcity driving prices upwards.

Nonetheless, it is important to keep in mind the fact that past performance does not reflect future results and that the markets are volatile and can be unpredictable.

Could Higher Oil Prices Threaten Central Banks’ Tightening Cycle Calendar?

Oil prices can play a pivotal role in inflation levels. As a major energy source and key input for numerous industries, its rise usually ripples through the economy, affecting the cost of transportation, production, heating, and even basic necessities, directly impacting worldwide household purchasing power.

This direct influence on inflation places oil as an important factor for central banks' decisions. Sustained price increases might prompt them to maintain a tighter monetary policy (or even raise interest rates) to curb the inflationary spiral that might occur.

In recent months, financial markets have been highly influenced by hopes that the Fed and other major central banks will cut interest rates in 2024.

However, recent market optimism hinges on the expectation of a slowdown in inflation and economic growth. Of course, several other economic factors influence how oil price fluctuations translate into real-world consequences, such as the stage of economic growth.

Oil Markets: What to Watch Out For This Week

This week, investors will be closely following news about tensions in the Middle East, as they can impact the supply side of oil, as well as reports from the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA), as they can provide key information about the demand side of oil. (Source: Bloomberg)

Conclusion

Because worries about oil supply due to increasing tensions in the Middle East have intensified, oil prices increased by almost 21% since the beginning of the year and are trading at their highest level in close to 5 months.

Oil acts as an unwitting conductor, influencing inflation, monetary policy, and consequently, financial markets. Traders should therefore monitor prices if they intend to trade the commodity and other financial markets such as indices, stocks and Forex.