PepsiCo hits the GLP-1 firewall

Key points

- Cost controls boost EPS: PepsiCo's Q3 earnings per share (EPS) grew 3% year-over-year to $2.31, despite a miss on organic revenue growth (1.3% vs. 3% estimated), thanks to strong cost control measures. This short-term strategy helped profitability but raises concerns about long-term growth potential.

- Obesity drug impact: The company is not addressing the potential long-term impact of GLP-1 drugs on the consumption of sugar and processed foods, which is a key risk as these medications are increasingly used to combat obesity, leading to reduced demand for PepsiCo's core products.

- Long-term structural headwinds: PepsiCo’s reliance on cost-cutting over investments could lead to declining growth, especially in light of falling U.S. obesity rates and structural challenges in the food industry, further amplified by the rise of obesity drugs. Investors are cautious about the long-term viability of this strategy.

PepsiCo beats on EPS as cost control is favoured over investments

PepsiCo reported Q3 results this Tuesday with shares gaining despite a miss on organic revenue coming in at 1.3% YoY vs est. 3%. Through effective cost controls PepsiCo was able to deliver earnings per share of $2.31 up 3% YoY. I still don’t get why investors are willing to reward PepsiCo for these results. Organic revenue growth is one of the key shareholder value drivers and this factor is deteriorating fast at PepsiCo. The stock’s total return has underperformed both the S&P 500 consumer staples sector and the S&P 500 Index over the past five years indicating that the business is structurally facing headwinds.

“Our businesses remained resilient in the third quarter, despite subdued category performance trends in North America, the continued impacts related to certain recalls at Quaker Foods North America and business disruptions due to rising geopolitical tensions in certain international markets. Strong cost controls aided our profitability, as we made incremental investments to improve our marketplace competitiveness,” said Chairman and CEO Ramon Laguarta.

This statement is worrying for several reasons. One, the company is completely silent about the GLP-1 drugs impact on obesity rates in the US and thus consumption of sugar and processed foods. This is a red flag when a management is not recognizing obvious threats to the business. The other worrying part of the statement is that PepsiCo’s management has chosen the path of cost controls to mitigate weak demand which can be okay in the short-term, but if it becomes longer term strategy it will lead to relative growth decline and shareholder value destruction down the road. If I was an investor in PepsiCo I would seriously consider the investment case again.

Why are food companies so afraid of mentioning obesity drugs?

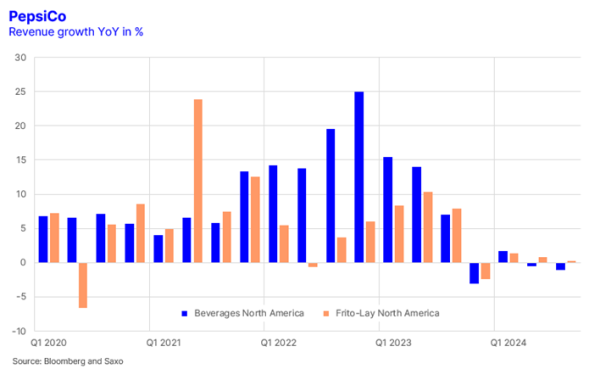

The chart below shows the two divisions in its North America business which account for 56% of total revenue. The beverage business did $7.2bn in Q3 and the Frito-Lay (snacks) did $5.9bn.

I do not think investors need more proof than this to see that there is a significant impact on the business in the past four quarters overlapping with the accelerated use of GLP-1 drugs to combat obesity. The US obesity rate has fallen for the first time in many decades and given the evidence that sugar and processed food are causal drivers of obesity, we can infer that PepsiCo and food industry could face structural headwinds for decades. The food industry has had an easy time for 50 years engineering great tasting food products ensuring moderate and stable growth rates in the developed world. With the new GLP-1 drugs humans for the first time have a firewall to protect themselves from the engineered products that taste so well that we grave more of it than what we need.

The annualized growth rate of the two North American businesses is -1.5% over the past four quarters. If we subtract the inflation rate over that period the business had a real growth rate of -4.7% which is quite a significant reduction in the business. Why are these food and beverage companies so afraid over talking about GLP-1 drugs? Well, the stock is valued at 21.2x earnings so there is an incentive for management to ensure a high valuation to protect the value of their stock options. As soon as management acknowledge the structural headwinds from GLP-1 drugs there will be a significant repricing of the stock which will destroy the value of these stock options.

At the end of the day, PepsiCo, McDonald’s, Coca-Cola etc. must accept the new reality and find a new way to redefine themselves. If not, it all becomes a game of cost control and capital allocation instead of investments and growth. If they choose the cost control strategy over a decade with structural headwinds on revenue it will be difficult to beat the market and over time investors will lose interest in the stock.