Potential Market Reactions to the Upcoming FOMC Meeting

Key points:

- Market Expectations vs. June Dot Plot: The market is pricing in more substantial rate cuts than the 25 basis points projected for 2024 in the Dot Plot, making a repricing in markets likely if expectations are not met.

- Market Reactions Based on Powell's Stance: A signal for a September rate cut could boost equities and weaken the US dollar, while a data-dependent approach may disappoint, strengthening the dollar but maintaining rate cut expectation

- Yield curve disinversion is likely: Approaching 4% yields on ten-year and two-year US Treasuries suggest a disinversion, driven by market expectations of a September rate cut and ongoing economic resilience.

Anticipated Scenarios for the Upcoming FOMC Meeting:

Scenario 1: Powell Indicates a September Rate Cut

Market will be encouraged to price in more rate cuts if Fed signals that keeping rates too high could jeopardise the desired soft landing. This could be positive for equities, especially interest rate sensitive sectors such as homebuilders, utilities and consumer discretionary. The rotation trade could get more legs, keeping small-caps in favor.

This could also be a positive for short-end bonds, while being a negative for the US dollar. We discussed the Powell Put in this article last week.

Scenario 2: Powell Misses the Market’s High Dovish Bar

If Powell maintains a data-dependent policy framework, that could upset investors who have already positioned for a Powell Put. However, market may find it difficult to shift expectations hawkish given that the data is supportive of rate cuts. There could be knee-jerk reactions in this scenario, which may be negative for equities and positive for the US dollar. However, these are unlikely to erase the long-running Fed put expectation, suggesting that risk-reward could still remain tilted towards positioning for rate cuts.

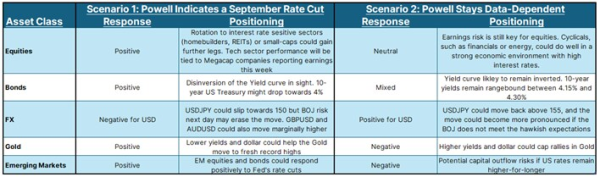

The below table shows potential market response and positioning under the two scenarios discussed above.

Important to monitor: the US yield curve is on the verge of disinversion. (contributed by Althea Spinozzi)

Despite the lull of the summer holidays, liquidity in bond markets remains underpinned. Since June, the Federal Reserve has decreased the pace of quantitative tightening by reducing the cap on US Treasuries from $60 billion per month to $25 billion. Additionally, the draining of the RRP (Reverse Repurchase Agreement) facility has stabilized around $400 billion. At the same time, bank reserves at the Federal Reserve remain well above $3 trillion, making a liquidity event unlikely.

Meanwhile, ten-year and two-year US Treasury yields are both approaching 4%, making a disinversion of the yield curve likely this week if the Federal Reserve pre-commits to a rate cut in September. Notably, the spread between 2-year yields and the Fed Funds rate is now well beyond 100 basis points, a level that signals markets have priced in an initial rate cut followed by additional cuts.

Even if the Fed doesn’t pre-commit to a September rate cut, the yield curve could still disinvert for the following reasons: the more data-dependent the Federal Reserve appears and the more resilient the economy remains, the less aggressive the upcoming rate cut cycle will be. This could create a tailwind for long-term treasuries, as a less aggressive rate cut cycle might increase the chances of a future recession.

Recent Macro articles and podcasts:

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

- 28 Jun: UK Elections: Markets May Be Too Complacent

- 24 Jun: Macro Podcast: Is it time to diversify your portfolio?

- 12 Jun: France Election Turmoil: European Equities Amidst the Upheaval

- 11 Jun: US CPI and Fed Previews: Delays, but Dovish

- 10 Jun: Macro Podcast: Nonfarm payroll shatters expectations - how will the Fed react?

- 3 Jun: Macro Podcast: It is a rate cut week