Pound Plunges As BOE Easing Expectations Soar

UK Inflation Tanks

The British Pound is seeing heavy selling pressure today on the back of the latest UK inflation figures released this morning. Headline annualised inflation was seen falling to 1.7%, from 2.2% prior, below the 1.9% expected. As well as being back below the BOE’s 2% target, inflation is now at its lowest level since April 2021. Looking at the breakdown of the data, the biggest downside contributors were transport (specifically air fares) and motor fuels. Notably, the drop in air fares was the largest since data collection started in 2001. Services inflation (a key element watched by the BOE), slowed to its lowest level since Q2 2022 at 4.9%. Meanwhile, food and non-alcoholic beverages saw the largest upside contribution.

BOE/Fed Divergence

On the back of the data, BOE easing expectations have risen accordingly. Traders are now pricing in a further .25% at the next meeting in November with forecasts for an additional cut in December also moving higher. In line with this shift in market pricing, GBP now looks vulnerable to a fresh downside near-term. Against the backdrop of the market’s less-dovish Fed outlook, the divergence between the two central banks should keep GBPUSD skewed lower as move through to the next central bank meetings.

Technical Views

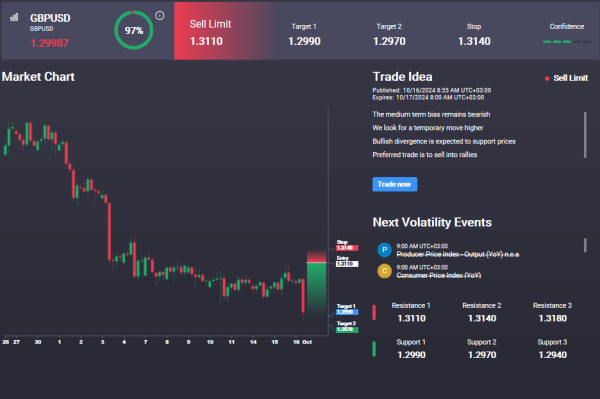

GBPUSD

The sell off in GBPUSD has seen the market breaking down below the 1.3136 level with the pair now testing support at 1.30. This is a key pivot area for price, with the bull trend line just below. If we break below here, 1.2832 will be the next bear target. In the Signal Centre today, we have a sell limit at 1.3110, suggesting a preference to stay short near-term.