Q1 earnings season starts today

Key points

- Financials are an attractive sector for investors due to their high dividend yield, potential for stock buybacks, and earnings growth. This is especially true compared to other sectors besides energy.

- Today is a significant day for financials because large banks like JPMorgan Chase are reporting earnings. Their performance will impact the entire sector.

- JPMorgan Chase in particular is seen as a strong investment due to its superior stock price performance and earnings growth over the past five years.

Financials are attractive

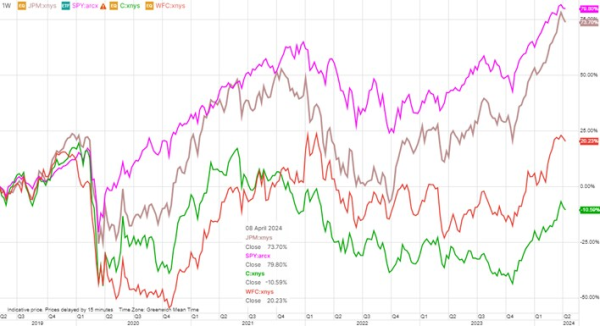

The Q1 earnings season has in theory already started, but this Friday is seen as the first day because it is the day with the first large cap companies reporting. Today’s key earnings focus is on JPMorgan Chase, Wells Fargo, and Citigroup all reporting before the US market opens.

Despite US technology stocks being the main driver of US equities due their large sector weight of 30% in S&P 500, the financials sector is still the second largest sector with a weight of 12.8% and banks such as those reporting today are crucial in our credit-driven economy. Therefore investors should still pay attention to financials.

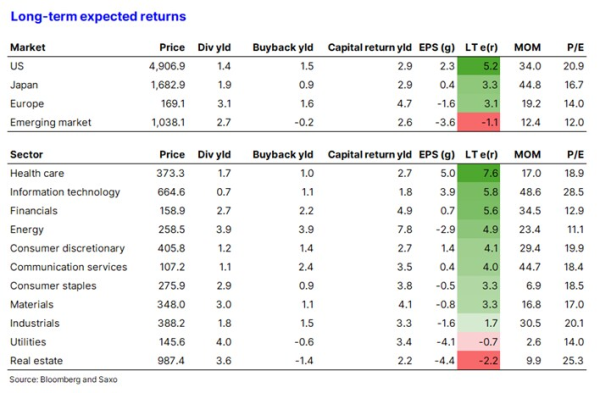

In our recent Q2 2024 Quarterly Outlook we highlight financials as a sector that we have a positive view on because of an attractive dividend yield and buyback yield as the table below shows. It is only the energy sector that has a more attractive direct shareholder yield. While the energy sector is not expected to have great real earnings growth, financials are expecting to track the long-term trend in the economy and when you add it all up financials are the third most attractive sector.

The higher for longer interest rate scenario that is playing out will also add meaningfully earnings growth for many financials and especially banks as they roll their balance sheet to higher interest rates. That is why you as an investor should watch today’s earnings and even consider financials in your portfolio.

JPMorgan Chase is in its own league

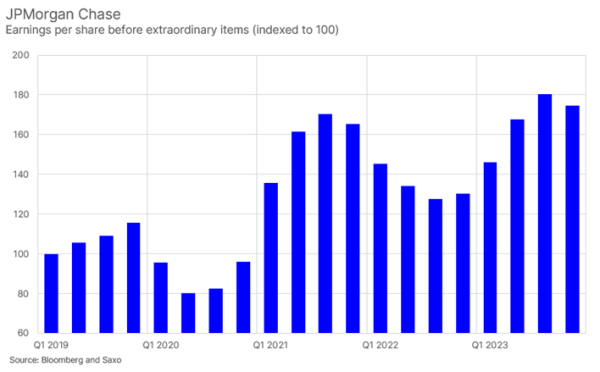

Of the three financials reporting today, JPMorgan Chase is in its own league over the past five years as Citigroup’s share price is actually down while Wells Fargo’s share price is only up 20% trailing the S&P 500 up 80% by a wide margin. Only JPMorgan Chase up 74% over the past five years have been close to keep up with the technology driven rally which is quite impressive. Their earnings per share growth (see chart) has also been phenomenal up almost 80% reflecting no increased valuation multiple over this period. Investors have been reluctant to change their long-term expectations of banks, so there is a considerable re-pricing scenario that could play out in financial stocks over the next year.