Q4 survey: Investors show growing caution amid global market uncertainty

As we transition into the final quarter of 2024, Saxo has conducted another survey of its clients, revealing a notable shift in market sentiment compared to previous quarters.

The latest Saxo Client Sentiment Survey indicates that investor confidence in global equity markets has softened. While many respondents remain optimistic, there is growing concern over inflation, interest rates, and geopolitical risks, all of which continue to shape market expectations for the next three months.

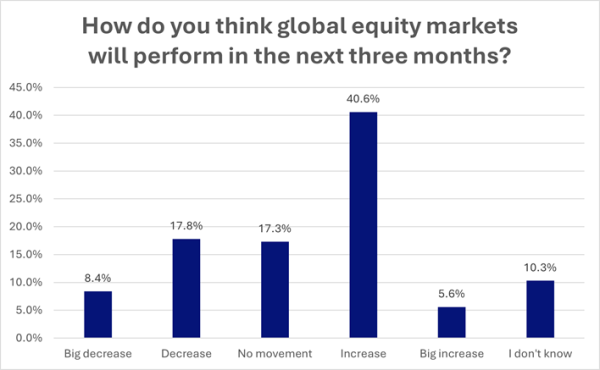

Equity market sentiment weakens, with fewer expecting significant gains

The Q4 survey reveals a dip in optimism regarding global equity markets compared to Q3. A large portion of respondents (40.6%) expect markets to increase, relative to 42.1% in Q3 and 50.5% in Q2. This caution among investors reflects the growing uncertainties surrounding economic conditions, with geopolitical tensions and inflation topping the list of concerns.

Outlier responses suggest heightened uncertainty and doubt

Curiously, the number of respondents in the most outlier positions (i.e., big increase and big decrease) has skyrocketed from Q3 to Q4. As such, 1.5% expected a big increase in Q3, whereas the same figure for Q4 is 5.6%. Similarly, 2.4% expected a big decrease in Q3, and now more than three times as many—8.4%—believe in a big decrease for Q4.

“We’re seeing a greater division of clients’ conviction about the markets, which makes sense given the increase in geopolitical risk and the upcoming US election in November,” says Peter Garnry, Chief Investment Strategist.

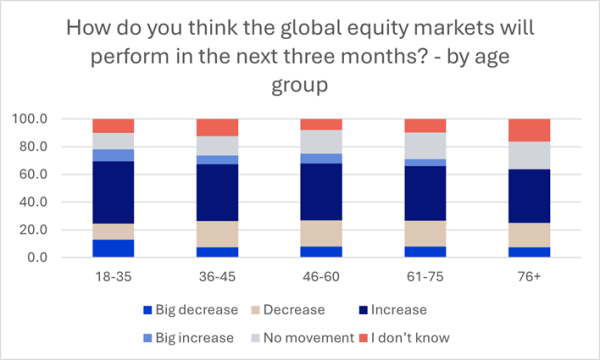

Young people remain the more optimistic bunch

As we described in our previous survey, we noticed a tendency for younger investors to be more optimistic than their more senior counterparts. As such, the 18–35 age group is the only one where more than half of the respondents expect either an increase or a big increase in the coming quarter.

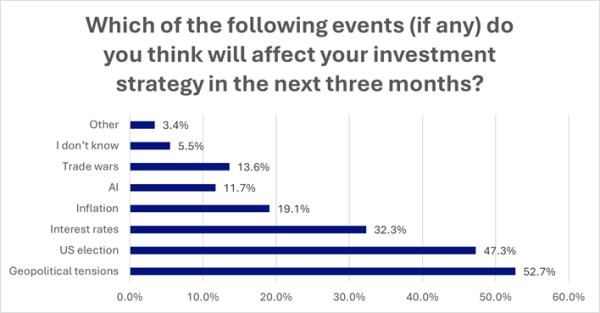

Geopolitical tensions, US election, and interest rates lead investor concerns

With the growing unrest around the globe, geopolitical tensions have established themselves as the biggest worry among investors, according to our survey. Like last quarter, the US election and interest rates are the second and third biggest worries.

“The sustained concerns about geopolitical tensions align with ongoing global conflicts and economic sanctions, while rising interest rates and inflation remain key risks for global markets. We also get closer to the US election – now less than a month away – and as such it seems relevant that geopolitical tensions, the election and interest rates are among investors top concerns,” says Garnry.

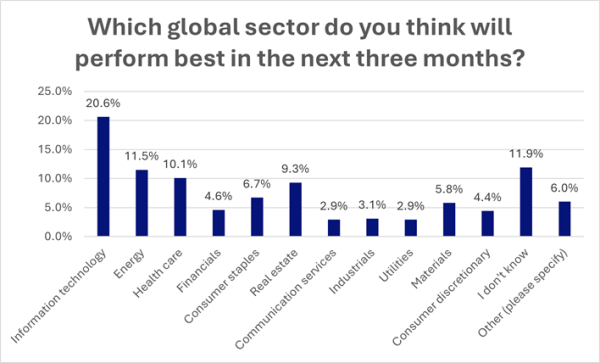

Sector outlook: Technology and health care lead the way

When it comes to sector performance, Saxo clients continue to view information technology, energy, and health care as the top performers. Information technology garnered the highest confidence, with 20.6% of respondents predicting it will be the best-performing sector in Q4, while energy garnered 11.5%, and health care was seen as the best performer among 10.1% of respondents.

“Interestingly, while Information Technology remains chief in this survey, we see that it has fallen quite drastically relative to Q3 and Q2 responses, which were both +30%. The underperformance in US technology stocks in Q3 has likely contributed to this. It is also odd to see the low conviction in utilities given it has been the best performing sector the past three months,” says Garnry.

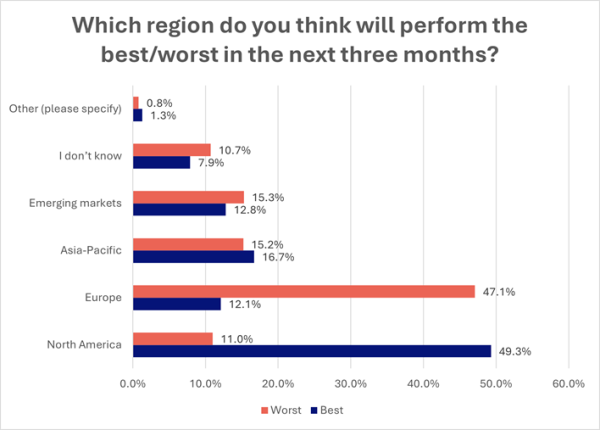

Europe is the most dubious region according to investors

When asked which region will perform the best in Q4, the majority of clients (49.3%) pointed to North America, which has been the case for the past two quarters as well. Europe is voted—by 47%—as the expected worst region for the final quarter of 2024, which has interestingly been the case throughout the lifetime of the survey.

“The classic narrative about American exceptionalism seems to remain strong despite increased worries about the US budgets, the election etc. Benchmarking this year’s performance from the US S&P 500 index and the EU EUROSTOXX 600 index, the American companies also outshine the European ones with almost three times as high a return. Whether it continues in a quarter where the US will be on everybody’s radar remains to be seen,” says Garnry.

See the full survey below

How do you think global equity markets will perform in the next three months? | |||

Q2 | Q3 | Q4 | |

Big decrease | 2.2% | 2.4% | 8.4% |

Decrease | 24.5% | 17.0% | 17.8% |

No movement | 15.2% | 29.8% | 17.3% |

Increase | 50.5% | 42.1% | 40.6% |

Big increase | 1.1% | 1.5% | 5.6% |

I don’t know | 6.5% | 7.2% | 10.3% |

Which global sector do you think will perform best in the next three months? | |||

Q2 | Q3 | Q4 | |

Information technology | 33.7% | 32.2% | 20.6% |

Energy | 17.4% | 6.4% | 11.5% |

Health care | 6.0% | 16.1% | 10.1% |

Real estate | 3.3% | 4.0% | 9.3% |

Consumer staples | 2.7% | 2.8% | 6.7% |

Materials | 10.3% | 7.7% | 5.8% |

Financials | 9.2% | 3.5% | 4.6% |

Consumer discretionary | 1.1% | 3.0% | 4.4% |

Industrials | 2.2% | 4.0% | 3.1% |

Communication services | 1.1% | 2.8% | 2.9% |

Utilities | 1.1% | 2.1% | 2.9% |

Other | 5.4% | 6.2% | 6.0% |

I don’t know | 6.5% | 9.0% | 11.9% |

Which region do you think will perform the best in the next three months? | |||

Q2 | Q3 | Q4 | |

North America | 48.9% | 47.6% | 49.3% |

Europe | 9.2% | 22.4% | 12.1% |

Asia-Pacific | 22.3% | 14.3% | 16.7% |

Emerging markets | 14.1% | 7.7% | 12.8% |

Other: | 2.2% | 0.8% | 1.3% |

None of the above/I don’t know | 3.3% | 7.4% | 7.9% |

Which region do you think will perform the worst in the next three months? | |||

Q2 | Q3 | Q4 | |

North America | 12.0% | 9.7% | 11.0% |

Europe | 40.8% | 25.9% | 47.1% |

Asia-Pacific | 17.9% | 18.7% | 15.2% |

Emerging markets | 18.5% | 30.8% | 15.3% |

Other: | 0.5% | 1.1% | 0.8% |

None of the above/I don’t know | 10.3% | 13.8% | 10.7% |

Which of below events (if any) do you think will affect your investment strategy in the next three months? | ||

Q3 | Q4 | |

Geopolitical tensions | 42.9% | 52.7% |

US election | 14.3% | 47.3% |

Interest rates | 37.1% | 32.3% |

Inflation | 24.2% | 19.1% |

Trade wars | 14.3% | 13.6% |

AI | 20.5% | 11.7% |

I don't know | 7.1% | 5.5% |

Others | 3.2% | 3.4% |

How do you think the global equity markets will perform in the next three months? | ||||||

Age | Big decrease | Decrease | Increase | Big increase | No movement | I don’t know |

18-35 | 13.0 | 11.6 | 44.9 | 8.7 | 11.6 | 10.1 |

36-45 | 7.5 | 18.8 | 41.3 | 6.3 | 13.8 | 12.5 |

46-60 | 8.0 | 18.8 | 41.1 | 7.1 | 17.0 | 8.0 |

61-75 | 8.1 | 18.5 | 39.4 | 5.0 | 19.3 | 9.7 |

76+ | 7.5 | 17.5 | 38.8 | 0.0 | 20.0 | 16.3 |

About the survey:

The purpose of the Client Sentiment Survey was to gain insights into the expectations of Saxo’s clients for the coming quarter.

The survey was distributed to Saxo clients between 23/09/2024-04/10/2024 and consisted of 712 respondents. The survey was executed in English, French, Dutch and Danish and sent to clients in the respective language markets.

See last quarter’s survey here.