Quick Brief – ECB cut rates by 25 bps as expected

- ECB’s announcement has no strong impact on the market

- Euro continues the selling interest

- September inflation revised down to 1.7% y/y

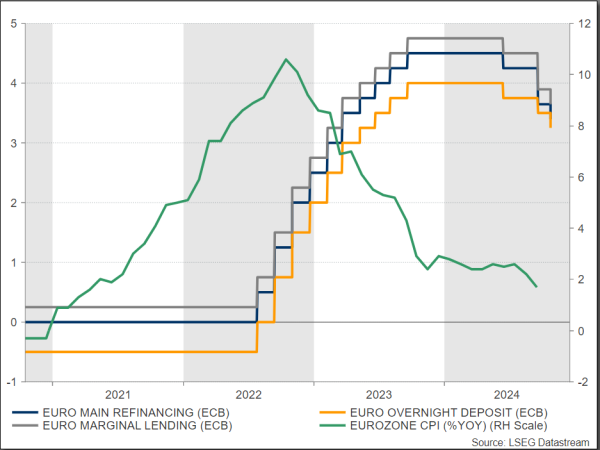

The ECB cut its interest rates by 25 bps in October as forecasted following similar moves in September and June. The ECB adjusted three different rates: 3.25% for the deposit facility, 3.4% for the main refinancing operations, and 3.65% for the marginal lending facility.

A more recent evaluation of inflation has shown that disinflation is making positive progress, which is the basis for this decision. For the first time in over three years, Eurozone inflation dropped below the ECB's target of 2% in September. The annual inflation rate was adjusted downwards to 1.7% in September, in contrast to preliminary forecasts of 1.8% and 2.2% in August. The short-term outlook is for inflation to climb, but by 2025, it should begin to fall again, heading towards the 2% target.

Wage growth remains high, but pay pressures are subsiding. The ECB maintained that it will continue to use a data-driven.

In addition, the Eurozone economy is showing more and more indications of weakness, with GDP growth revised down to a modest 0.2% in Q2 and PMIs showing a continued contraction in manufacturing and slowing growth in services.

Euro/dollar is continuing the strong selling interest that began at the 1.1200 round number, and it experienced a mild reaction during the announcement of the decision. The next target to look for would be the medium-term uptrend line around 1.0800.