Quick Brief – German CPI eases further

- Preliminary German CPI drops to 1.6% yoy change

- The October ECB rate cut is almost a done deal

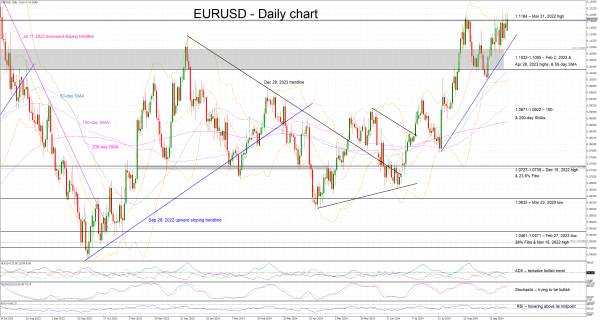

- Euro/dollar in the green again today

The German preliminary inflation report for September produced a downside surprise by printing at 1.6%, against expectations for a 1.7% figure, following the 1.9% yoy increase recorded in August. The respective German states’ prints led by the North-Rhine Westphalia region, announced earlier today, somewhat prepared the market for this weaker CPI print.

Following Friday’s significant miss at both the French and Spanish CPI reports and today’s weaker Italian inflation, there is strong possibility for a downside surprise at tomorrow’s eurozone aggregate figure, which is currently forecast to drop to 1.9% yoy increase from 2.2% in August.

This weaker German inflation print has almost sealed another 25bps cut at the October 17 ECB meeting, and, on the margin, could allow the doves to pursue an even stronger rate move. In the meantime, euro/dollar has lost a bit of ground following the release of the German CPI, but it remains firmly in the green as the market is preparing for some key data releases in the US.