Quick Brief – ISM non-mfg. PMI ticks up, but offers little relief

ISM non-mfg. PMI rises to 51.5 from 51.4

Prices charged and new orders improve, but employment cools

This leaves some traders concerned ahead of tomorrow's NFP

The ISM non-manufacturing PMI rose to 51.5 from 51.4, with the prices paid and new orders subindices rising as well. However, employment cooled further, with the respective index falling to just a tenth above stagnation.

Overall, the report was received as encouraging by the financial world, with equities rebounding as fears about the performance of the US economy may have subsided. The US dollar also gained somewhat as the probability of a 50bps at the upcoming Fed gathering dropped back to 41% from 45%.

Having said that though, market participants seem to have reacted with caution as the subdued employment subindex reasonably keeps a degree of concern visible ahead of tomorrow’s official NFP report and this is evident by the fact that the probability for a double rate cut on September 18 remains decent.

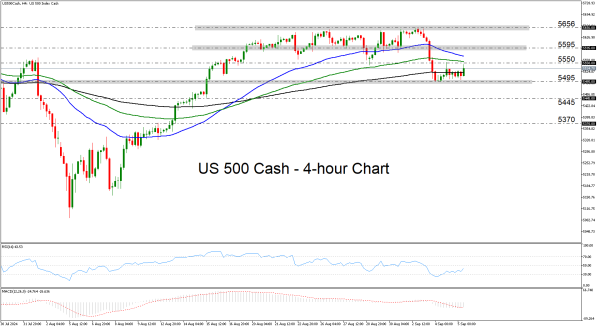

The US 500 index rebounded, but the reaction is far from suggesting that the short-term outlook has turned back to positive. Although the index remains supported by the 5,495 zone, it seems unable to return above the 5,550 area at the moment. The move signaling that the bulls are trying to gain the upper hand again may be a decisive recovery above the 5,595 zone.