Quick Brief – It’s Fed time!

Will the Fed cut interest rates by 25bps or 50bps?

A 25bps reduction could be the wiser choice

But there are upside risks even in the case of a 50bps cut

The much-awaited FOMC decision has finally arrived. In a few hours, the Committee will make known to the world whether it has decided to cut interest rates by 25 or 50 basis points.

According to Fed funds futures, the probability of a bolder 50bps reduction currently rests at around 25%, with the remaining 75% pointing to a quarter-point cut. That said, a survey of investing.com readers showed that 60% of them expect the Fed to announce a quarter-point cut.

Indeed, with no signs of an imminent recession, a 25bps cut may be the wiser choice, as it will allow policymakers to evaluate incoming data without elevated risk of inflation spiraling out of control again.

But even if we do get the bolder 50bps cut, the dot plot is unlikely to match the ultra-dovish market expectations for the rest of the year, and Powell may justify the move by characterizing it as front-loading.

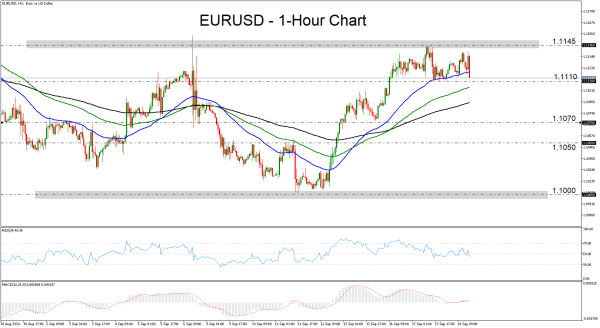

Both scenarios could lead to a stronger dollar, with EURUSD coming back down to – or even falling below – the round figure of 1.1000.