Quick Brief – PCE inflation data not a game changer

- Headline PCE inflation slows, but core rate ticks up

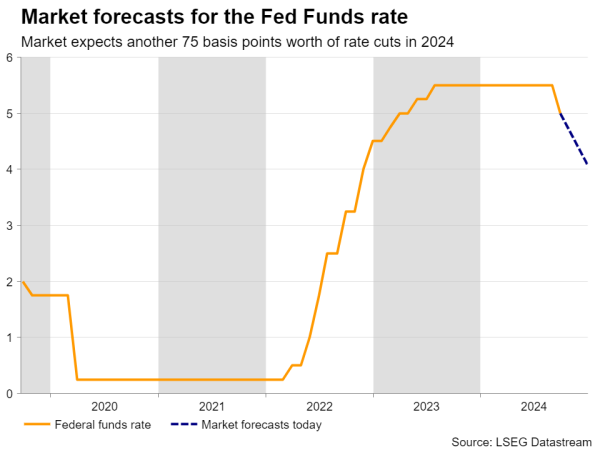

- Investors continue to expect 75bps of additional cuts this year

- Focus now turns to next week’s ISM PMI and NFP data

The headline PCE inflation rate dropped to 2.2% y/y in August, confounding expectations of a smaller drop to 2.3% from 2.5%. The more important core PCE rate ticked up to 2.7% y/y from 2.6%.

Nonetheless, given that this inflation data set was accompanied by softer income and spending numbers, investors maintained their overly dovish bets with regards to the Fed’s future course of action, and the dollar slid somewhat.

According to Fed funds futures, market participants continue to believe that the Fed will cut interest rates by another 75bps by the end of the year, despite the Fed’s own dot plot pointing to 50. There is also a 54% chance for a back-to-back 50bps cut at the November gathering.

What could shed more light on how the Fed could proceed with interest rates in the months to come may be next week’s ISM PMIs and, more importantly, Friday’s NFP jobs report.