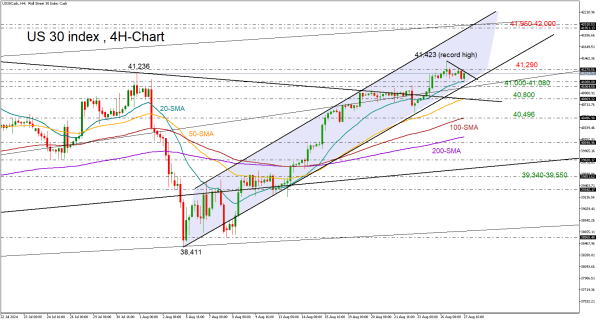

Quick brief – US 30 index hangs near record high

US 30 benefits from weaker correlation with tech stocks; holds near record high

Downside risks remain, but sentiment still positive above 41,000

The US 30 index has less exposure to AI-related technology companies and that partially explains why it has gained only 9.7% year-to-date versus the double-digit growth of around 19% in the US 500 and US 100 indices.

On the other hand, the relatively weaker correlation with tech stocks could be a privilege when investors become anxious about the excessive AI excitement and the stretched stock valuations.

With Nvidia’s earnings due this Wednesday after the market close, traders trimmed some of their exposure in the US 100 and the US 500 stock indices on Monday despite optimism for strong earnings, whilst the US 30 index ticked by 0.2% to unlock a new record high of $41,423 on the back of increases in stocks such as 3M Co, Disney, American Express, and Caterpillar.Tuesday's session started with mild losses, but the 20-period simple moving average (SMA) provided a strong helping hand near $41,090. The positive surprise in the US CB consumer confidence index added some impetus to the price a couple of minutes ago, though downside risks have not evaporated yet as the doji candlestick at the top of the uptrend is still questioning the case of a bullish trend continuation towards $41,950-$42,000. Yet, as long as the $41,080 floor holds, the focus will remain on the upside. Specifically, the $41,290 region should give way for a meaningful rally.

In the opposite case, if the index slips below $41,000, the 50-period SMA could come to the rescue at $40,800 ahead of the 100-period SMA at $40,496.