Quick Brief – US CPI data holds clue to upcoming Fed decision

US CPI climbed to 2.5% from 2.9% before

85% probability for 25bps rate cut

Dollar rises ahead major currencies

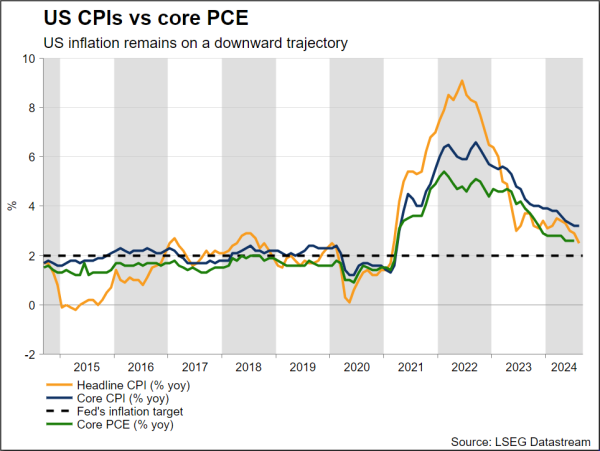

The release of the August US CPI data captured the attention of traders. The headline figure showed a slowdown to 2.5% from 2.9%, marking the lowest annual growth rate since February 2021. Meanwhile, the core CPI remained unchanged at 3.2%.

But as investors scrutinize the CPI report, the Fed has hinted that it's paying as much if not more attention to the jobs market when it comes to its policy decisions.

Despite the fact that it is widely anticipated that the Federal Reserve will reduce interest rates next week, the magnitude of the rate cut is still uncertain. This is particularly true given that Friday's mixed labor report left no clear indication of the central bank's potential path.

Currently, the markets are predicting an 85% chance of a 25 bps rate cut on September 18, with a 15% chance of a 50 bps reduction.

The impact on the greenback following the data release was significant enough to bring the market back to its opening levels today. The dollar/yen gained some ground, returning above 142.00; the euro/dollar is flirting with the 1.1000 round number; and the dollar index is holding close to 101.50. Moreover, gold prices retreated from their all-time highs.